NO BYLINE, THANK YOU

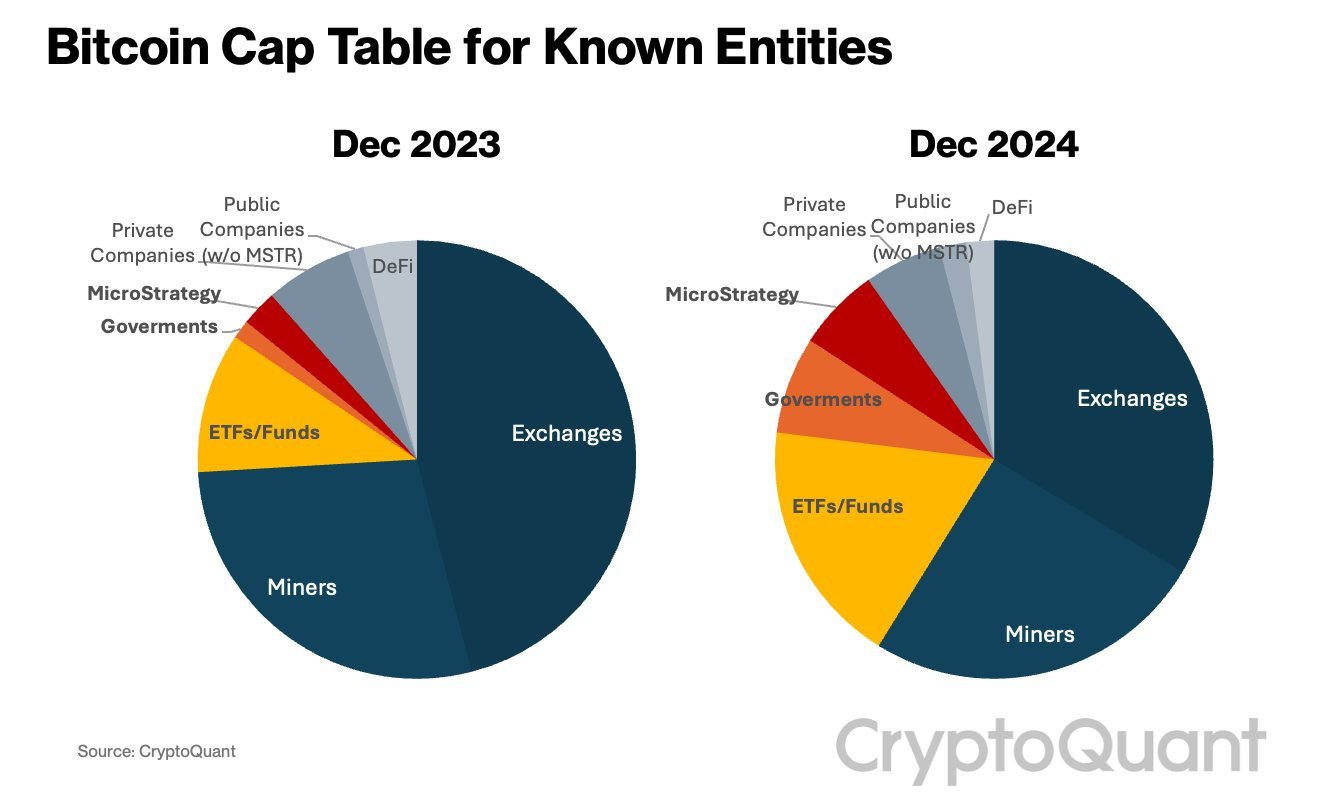

Exchange-traded funds (ETFs), governments and MicroStrategy (MSTR) own nearly one-third of all known Bitcoin (BTC) holdings.

The 31 of known BTC holdings owned by ETFs, governments and MicroStrategy represents a 14 increase from December 2023, according to Ki Young Ju, the founder and chief executive of the digital asset analytics firm CryptoQuant.

-->“Bitcoin Cap Table Update: ETFs, governments, and MSTR now account for 31 of all known Bitcoin holdings, up from 14 last year.”

Source: Ki Young Ju/X

Source: Ki Young Ju/XYoung Ju also discussed the importance of MicroStrategy’s BTC holdings.

“Different forms of money require distinct gateways.

Bitcoiners should recognize MSTR as a gateway bridging Nasdaq-100 money to Bitcoin.

I don’t understand why some Bitcoiners dislike MSTR. They might raise concerns about self-custody, but very few people actually practice self-custody — just as only a few care about privacy breaches. MSTR’s Bitcoin bank model aligns well with the current adoption level.

If the gateway’s active fund management enables the acquisition of a significant amount of Bitcoin with relatively little capital, that marks the success of a Bitcoin bank.

Of course, there is always the risk of failure, so one should view it as entrusting funds to a bank with the goal of gaining more Bitcoin, using Bitcoin itself as the form of money.”

Bitcoin is trading at $93,895 at time of writing. The top-ranked crypto asset by market cap is down nearly 2 in the past 24 hours.