An estimated $90 trillion transfer of wealth is now underway as baby boomers begin to give assets to their children – and a new survey shows a massive transfer of debt is happening at the same time.

A whopping 46 of Americans expect to pass on some form of debt when they pass away, according to a new survey by Policygenius.

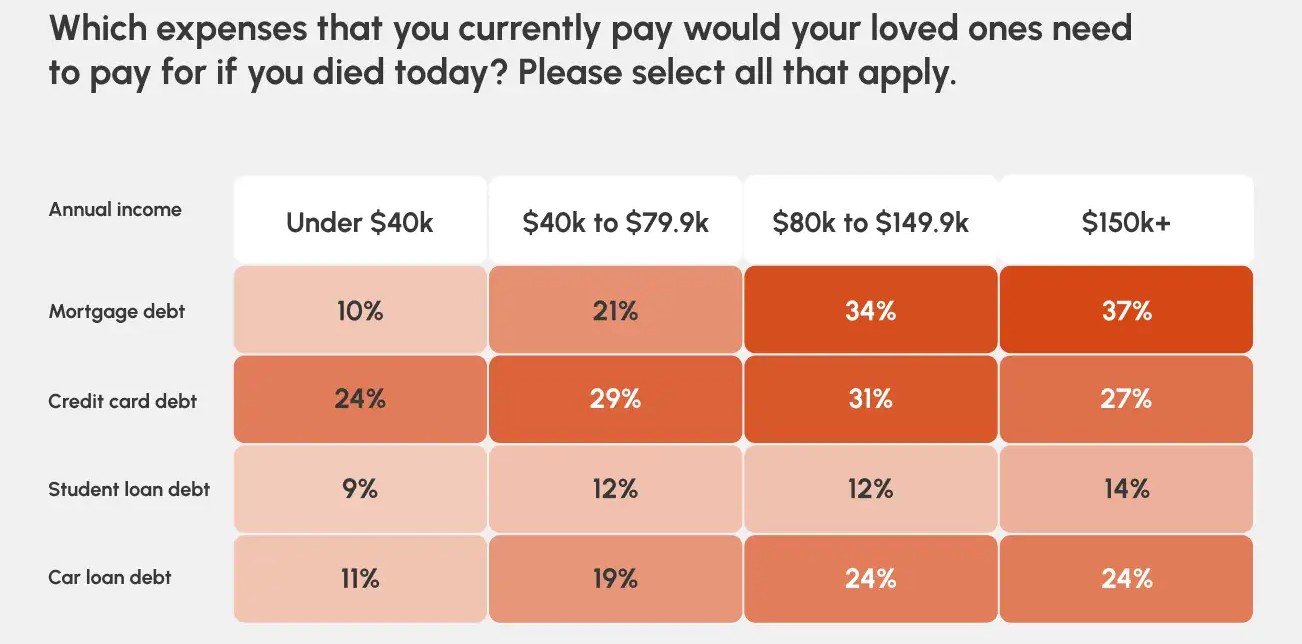

-->The survey shows 58 of people who earn at least $150,000 a year expect their loved ones to inherit their debts when they die.

For those who earn less than $150,000 per year, that number drops to 47.

According to numbers compiled by Yahoo Finance, the average American household owes about $10,000 in credit card debt, $241,000 in mortgage debt, $59,000 in student loan debt and $22,000 in car loans.

And Policygenius says that among the pool of Americans who expect to leave debt behind, 21 do not have life insurance that would help pay it off.

Source: Policygenius Financial Planning Survey 2024

Source: Policygenius Financial Planning Survey 2024Zooming out, a total of 43 of baby boomers say their loved ones would need to pay off debts if they passed away now, compared to 52 of millennials.

And 60 of Americans who are currently living with their kids say their loved ones would need to pay their debts if they died today, compared to just 38 of those who don’t live with their children.

Policygenius commissioned YouGov to conduct the survey, polling 4,063 Americans 18 or older with a margin of error at +/- 2.