New research from VanEck reveals that Bitcoin (BTC) miners are shifting to artificial intelligence (AI) and high-performance computing.

In a thread on the social media platform X, Matthew Sigel, the head of digital assets research at VanEck, says that BTC miners are utilizing technology to earn profits through strategic arbitrage.

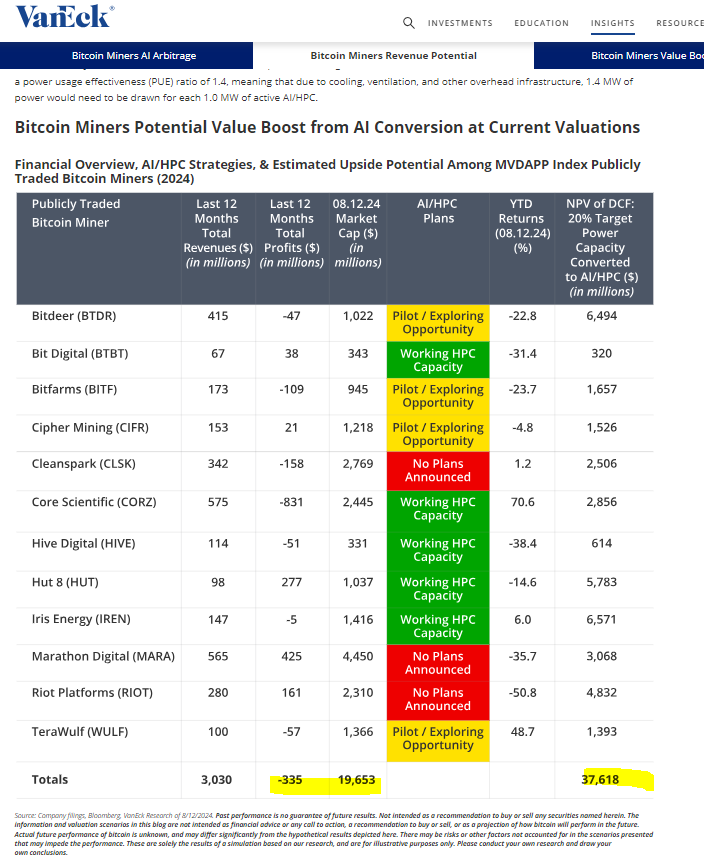

-->“Bitcoin miners are shifting to AI and high-powered computing (AI/HPC), unlocking new revenue through strategic arbitrage. We estimate a $38 billion net present value opportunity by converting 20 of their collective capacity by 2027. (For context, the combined market cap of the stocks we looked at is $19 billion).”

Source: Matthew Sigel/X

Source: Matthew Sigel/XAccording to VanEck, AI projects are energy-intensive endeavors and Bitcoin miners are well-positioned to address the issue and generate a new income stream.

“The synergy is simple: AI companies need energy, and Bitcoin miners have it. As the market values the growing AI/HPC data center market, access to power – especially in the near term – is commanding a premium… Existing Bitcoin miners are uniquely equipped to support AI/HPC immediately.”

According to VanEck’s data, publicly traded BTC miners currently control a record percentage of Bitcoin’s hashrate while their overall market cap hit all-time highs in July.

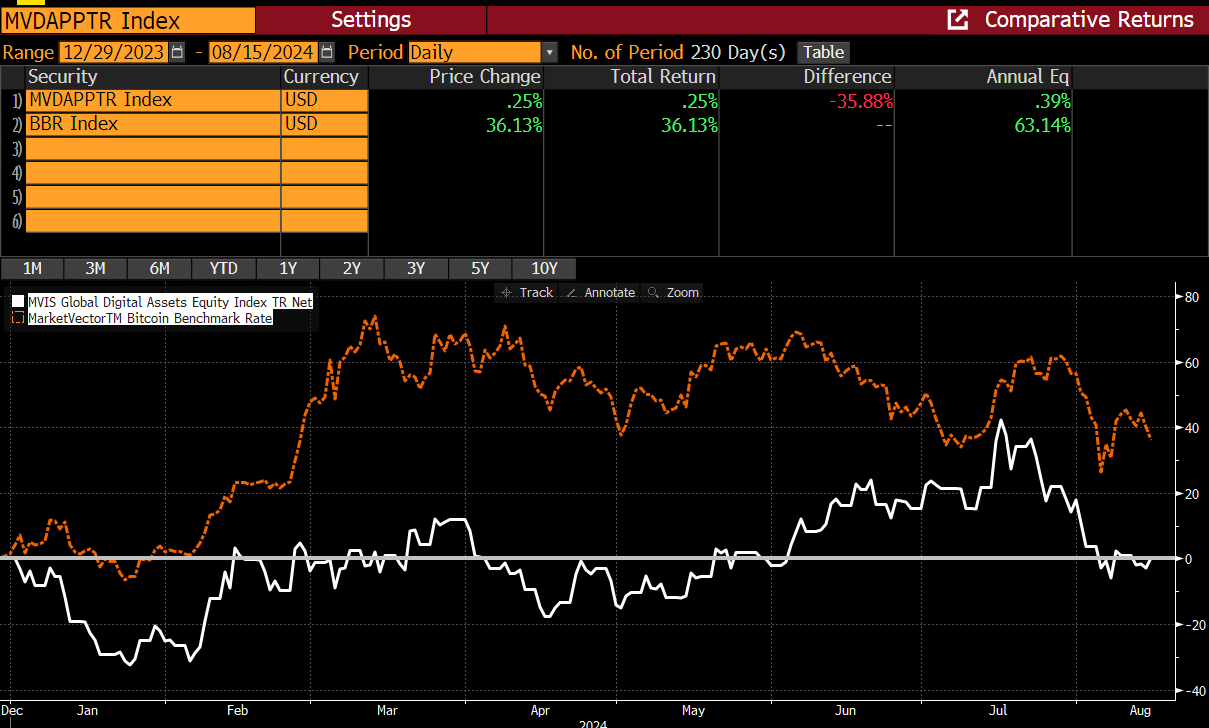

However, Sigel says that when crypto markets corrected in August, the MarketVector Digital Asset Equity Index – which keeps track of the performance of the largest and most liquid companies in the digital assets industry – started heavily underperforming against Bitcoin.

“After the recent correction, however, the MarketVector Digital Asset Equity Index, tracking these stocks, is flat year-to-date, underperforming the Bitcoin price by 3,800 basis points. At these levels, we believe investors are missing a story that could double the market cap of the stocks, even with no change in Bitcoin mining profits.”

Source: Matthew Sigel/X

Source: Matthew Sigel/X