Bitcoin (BTC) is testing a key zone amid a fall in the level of the crypto king’s volatility, according to analytics platform Glassnode.

Glassnode says that since Bitcoin hit a low of around $107,000 at the beginning of September, Bitcoin’s volatility levels have fallen.

-->The low-volatility regime is unlikely to last for long, however, according to Glassnode.

“Such calm rarely lasts, volatility spikes tend to follow. The market is nearing a breakout point, with momentum ready to shift.”

According to Glassnode, one of the metrics demonstrating the reduced momentum is the realized profit.

“It’s [realized profit] now at $1.17 billion per day, down approximately 47 from the $2.2 billion June peak, yet still above the bear-phase baseline (less than $0.8 billion). Momentum is fading, and the balance is becoming fragile.”

Source: Glassnode/X

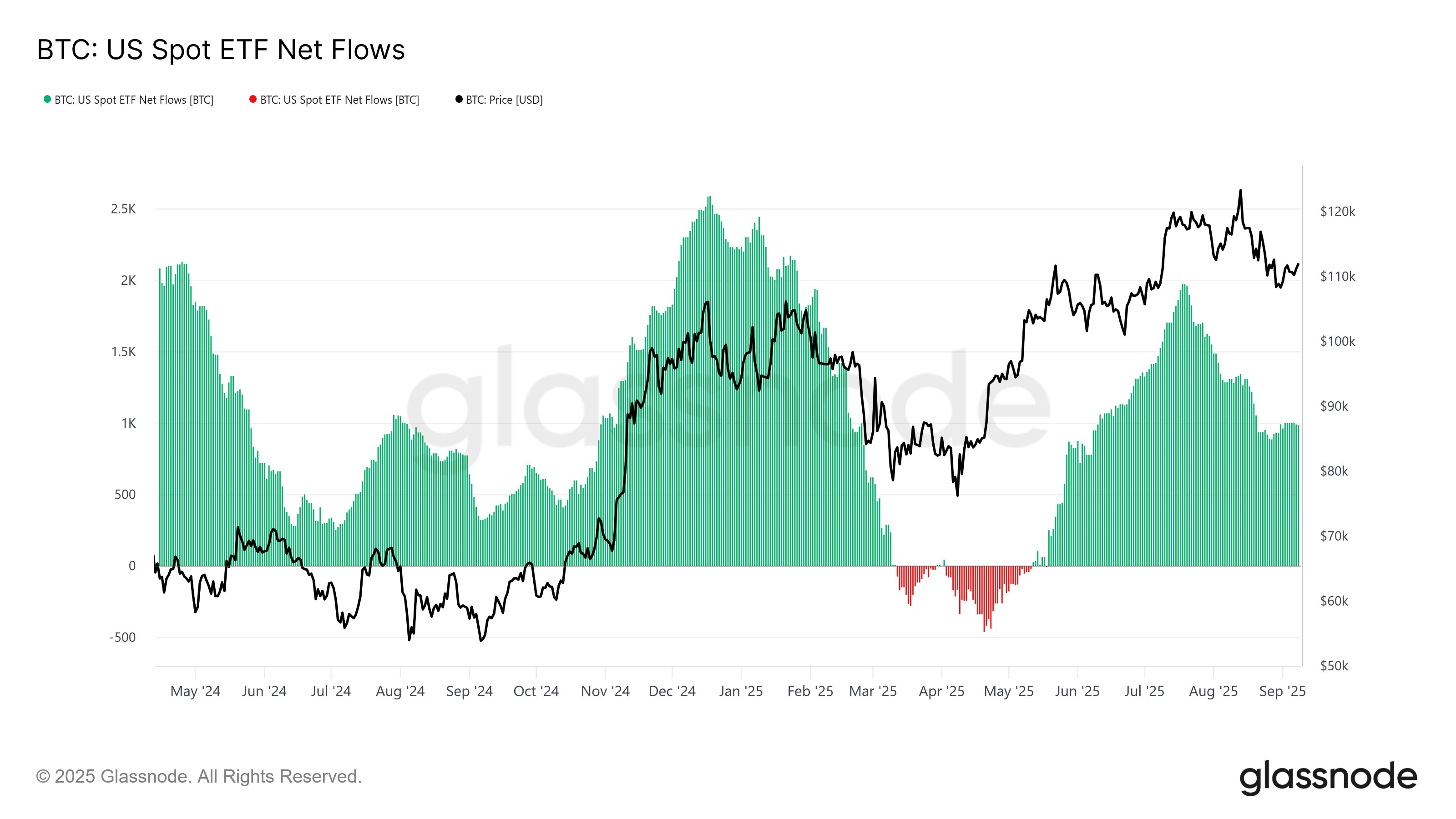

Source: Glassnode/XGlassnode also says that capital inflows are signaling the decline in momentum, as evidenced by net inflows into US spot exchange-traded funds (ETFs).

“A similar trend appears in Netflow to US Spot ETFs (90-day smooth moving average), now at approximately 980 BTC per day – down approximately 50 from the July peak of 1,960 BTC per day. This marks a clear decline in [traditional finance] TradFi buy-side momentum, signaling weakening institutional demand.”

Source: Glassnode/X

Source: Glassnode/XOn Bitcoin’s outlook amid a decline in momentum, Glassnode says,

“However, the drop to $107,000 triggered fear-driven selling from top buyers, forming a textbook setup for local bounce-backs. A short-term rally toward $114,000 is likely, but as long as price trades below that level, the broader bias leans toward bearish continuation.”

Bitcoin is trading at $112,390 at time of writing.

Follow us on X, Facebook and Telegram