Bitcoin (BTC) has tagged the $91,500 level for the first time since March 7th as institutional holdings of the flagship crypto asset enjoy a significant boost.

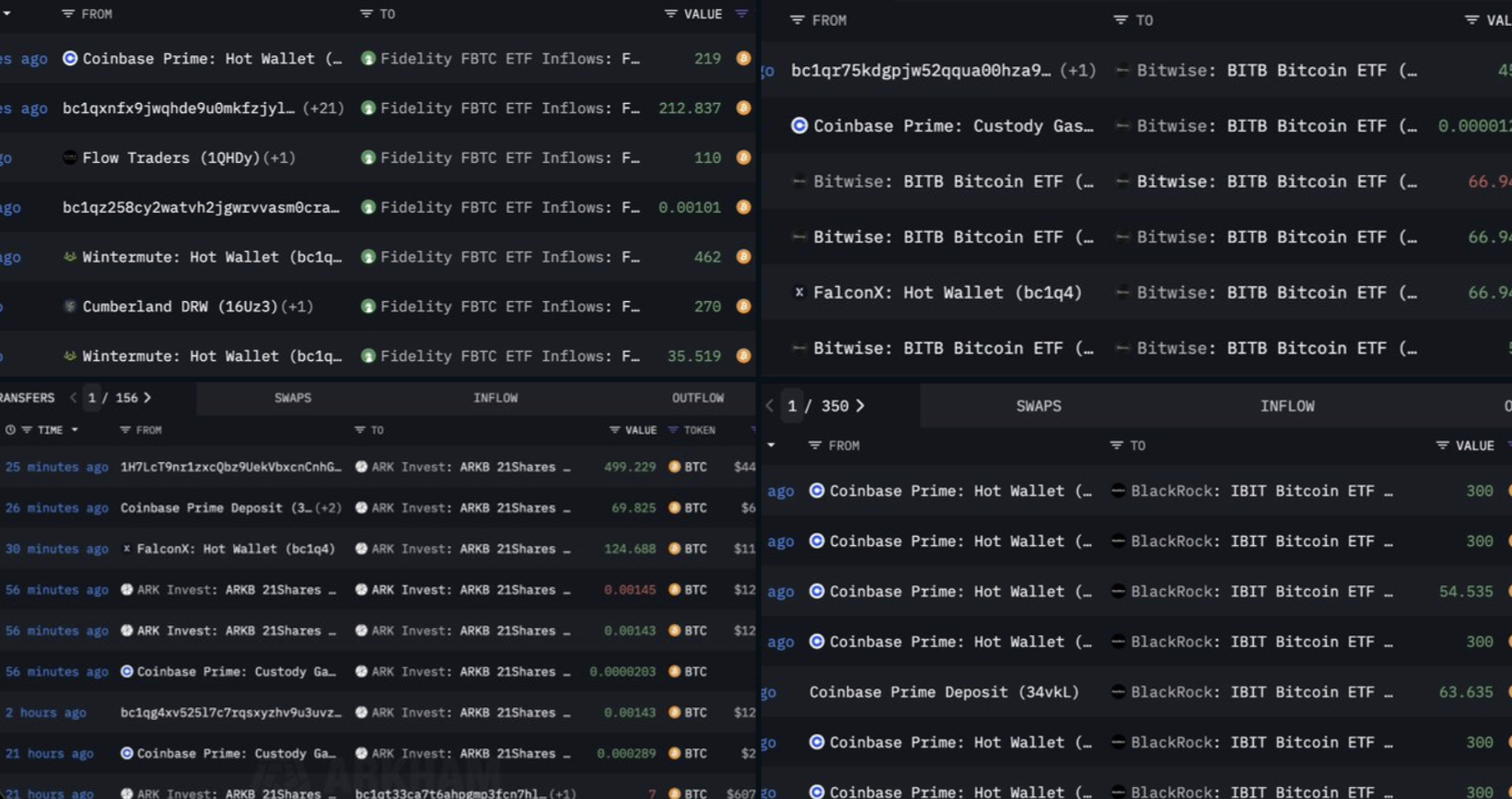

According to blockchain tracking firm Lookonchain, BlackRock and several other large US institutions have upped their Bitcoin stacks to back their BTC-based exchange-traded funds (ETFs).

-->Says Lookonchain, citing data from Arkham,

“BTC is back to $90,000.

Fidelity, BlackRock, ARK Invest, Bitwise are all accumulating BTC.”

Source: Lookonchain/X

Source: Lookonchain/XAccording to crypto data aggregator SoSoValue, Bitcoin ETFs saw $381 million in flows on Monday, April 21, with none of the 12 ETFs seeing net outflows.

The flows are the largest recorded since January 30.

However, Ethereum (ETH) ETFs haven’t seen the same amount of demand. According to SoSoValue, Ethereum ETFs have suffered net outflows for the majority of days since mid-February, including today.

But some under-the-radar whales have been spotted on-chain accumulating ETH from crypto exchanges.

Says Lookonchain,

“Whales are still accumulating ETH.

0xd81E withdrew 1,900 ETH ($3.1M) from Gate.io again [on Tuesday].

Since Feb 15, this wallet has withdrawn 48,477 ETH ($100.35M) from Gate.io and is currently sitting on a $21M loss.

Meanwhile, 0x3bd2 withdrew 2,600 ETH ($4.26M) from Binance after being inactive for a year.”

At time of writing, Bitcoin is trading at $90,777 while ETH is priced at $1,692.