A Bloomberg analyst says that the U.S. Securities and Exchange Commission (SEC) is gearing up to approve all bids for a spot market Bitcoin (BTC) exchange-traded fund (ETF).

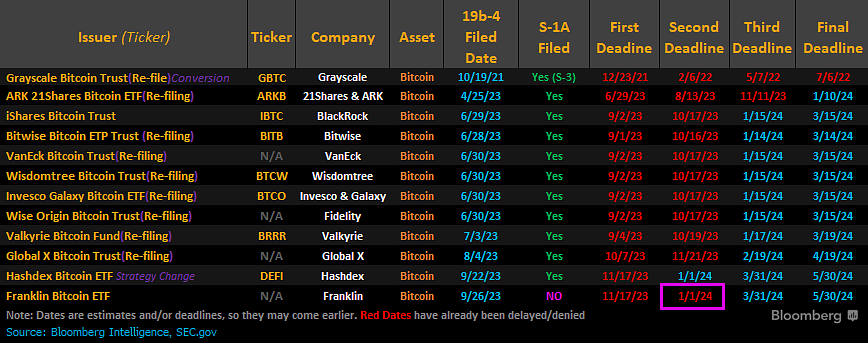

In a lengthy thread on the social media platform X, James Seyffart says that the SEC making earlier-than-expected rulings on Franklin’s bids for a BTC ETF means the regulatory agency could be setting the stage to approve the others in January.

-->“Wow. SEC went super early on Franklin. They weren’t due for another decision until Jan 1. Notably, Franklin is the only issuer who didn’t submit an updated [Form] S-1 (registration of asset-backed security) yet. Wonder if that has any impact here…

Going super early on Franklin today (and potentially Hashdex coming too?) would set things up for a full wave of approvals in early January.”

However, the SEC didn’t end up ruling early on Hashdex’s bid. Instead, the regulatory body pushed it back to a specific date, prompting Seyffart to believe that the SEC is aiming to approve all BTC ETF applications at the same time.

Source: James Seyffart/X

Source: James Seyffart/X“This delay on Hashdex all but confirms for me that this was likely a move to line every applicant up for potential approval by the Jan 10, 2024 deadline.”

However, Seyffart says the process may not go smoothly as there could be some hang-ups with the filing process or the SEC may end up denying the bids.

“Gonna sprinkle some caveats here:

1. This is just the 19b-4 (new derivative security product filing) approvals. We know from updates and other sources that [the] SEC still isn’t quite ready to approve the S-1s (prospectuses) just yet. So approval could happen here without immediate launch.

2. They could still be denied.”