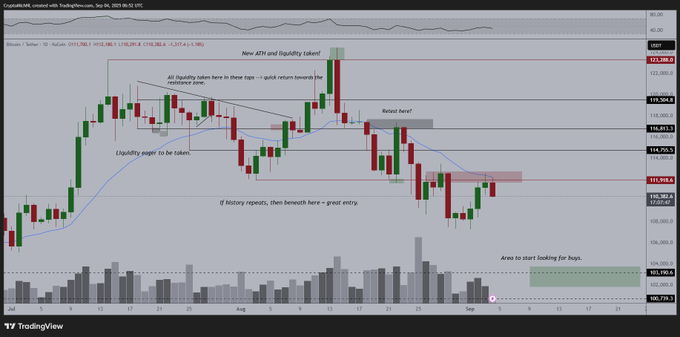

Cryptocurrency analyst and trader Michaël van de Poppe says Bitcoin (BTC) is primed to go lower after failing to break above a major resistance level.

Van de Poppe tells his 805,800 followers on X that Bitcoin has failed to climb above the 20-day exponential moving average (EMA). According to Van de Poppe, a correction for Bitcoin could present buying opportunities for altcoins.

-->“If this [Bitcoin] isn’t breaking through, I would project we’re making a new low and that’s where you need to go maximum long altcoins.

Brace for impact.”

Source: Michael van de Poppe/X

Source: Michael van de Poppe/XOn the upcoming Federal Open Market Committee meeting set for September 17th, where the Federal Reserve will issue a rate decision, Van de Poppe says,

“Yes, we could have a deeper correction and yes, I’m heavily buying that one, but the closer we get to the FED meeting, the less of a chance I’d give the correction to continue, especially if BTC breaks through $112,000.”

Bitcoin is trading at $110,083 at time of writing.

Turning to Ethereum (ETH), Van de Poppe says the second-largest crypto asset by market cap could plummet if it fails to break above the 20-week EMA.

“If it breaks back above the 20-Week EMA, I would assume we’re going to see a strong surge towards the all-time high.

If not, then I’m heavily interested to be buying it at sub $4,000.”

Source: Michael van de Poppe/X

Source: Michael van de Poppe/XEthereum is trading at $4,355 at time of writing, down by around 12 from the all-time high reached late last month.

Follow us on X, Facebook and Telegram