Bitcoin transfers to and from crypto exchanges have fallen, signaling that markets remain cautiously optimistic about the market.

A breakdown of net transfer volume by size shows that both deposits and withdrawals to and from exchanges have decreased recently, despite bitcoin‘s price uptick this year. The data suggests that investors are still weighing the latest, sometimes conflicting economic indicators but are also upbeat enough to hold onto their BTC instead of placing it on exchanges to trade.

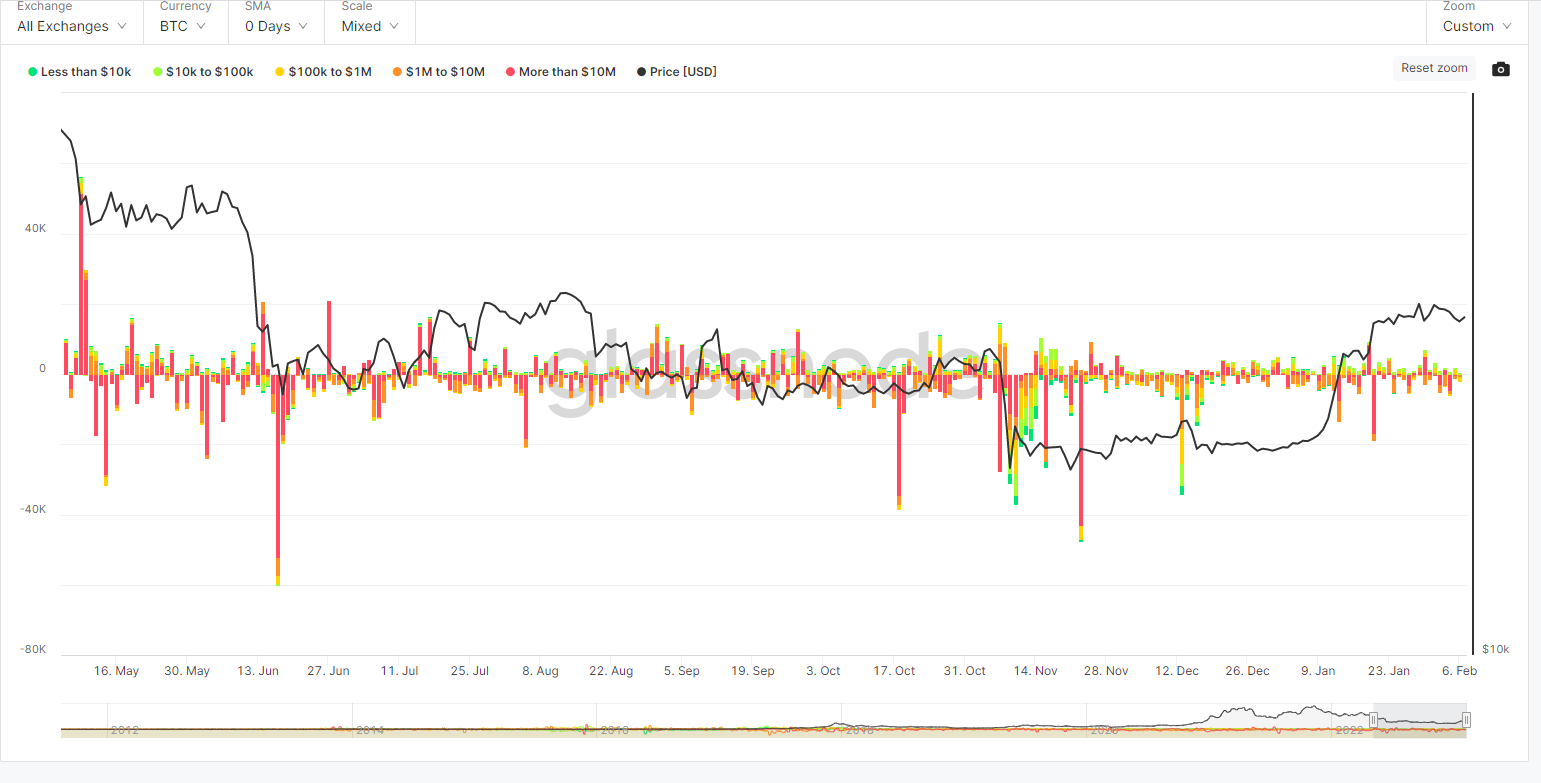

Net transfer volume, which was recently updated by analytics firm Glassnode, presents a visual snapshot of coins sent to or removed from centralized exchanges, categorized by size. By looking at past trends it can help market observers determine what investors are likely to do in the future.

In May 2022, net transfer volumes spiked above 40,000, which ultimately preceded a 37 decline in BTC price from $30,380 to $19,000. Conversely, the decline to $19,000 accompanied a withdrawal of close to 60,000 bitcoin.

Bitcoin: Net transfer volume from/to exchanges by size (Glassnode)

The movement of coins on and off of exchanges is not a cause of price movement as much as it reflects investor sentiment. As investors begin to fear price declines, they tend to send more BTC to exchanges. The opposite occurs when investors are bullish.

The recent drop implies that investors may be reluctant to make a call in either direction at the moment.

Bitcoin’s has risen about 38 year to date and 44 over the last 90 days. As a result, many traders could take profits. The absence of a sharp increase in BTC deposits to exchanges should be an encouraging sign for bullish investors.

In short, prices have spiked, investors seem content for the moment, and action has stalled accordingly. Volatility has also narrowed, with the Average True Range (ATR) for BTC falling 13 over the last five trading days.

Trading volume for BTC has also declined, falling below its 20-day moving average for five consecutive trading days, and in eight of the last 10.