The venture capitalist Arthur Cheong is calling attention to one decentralized exchange (DEX) altcoin he thinks is primed for a bullish trajectory.

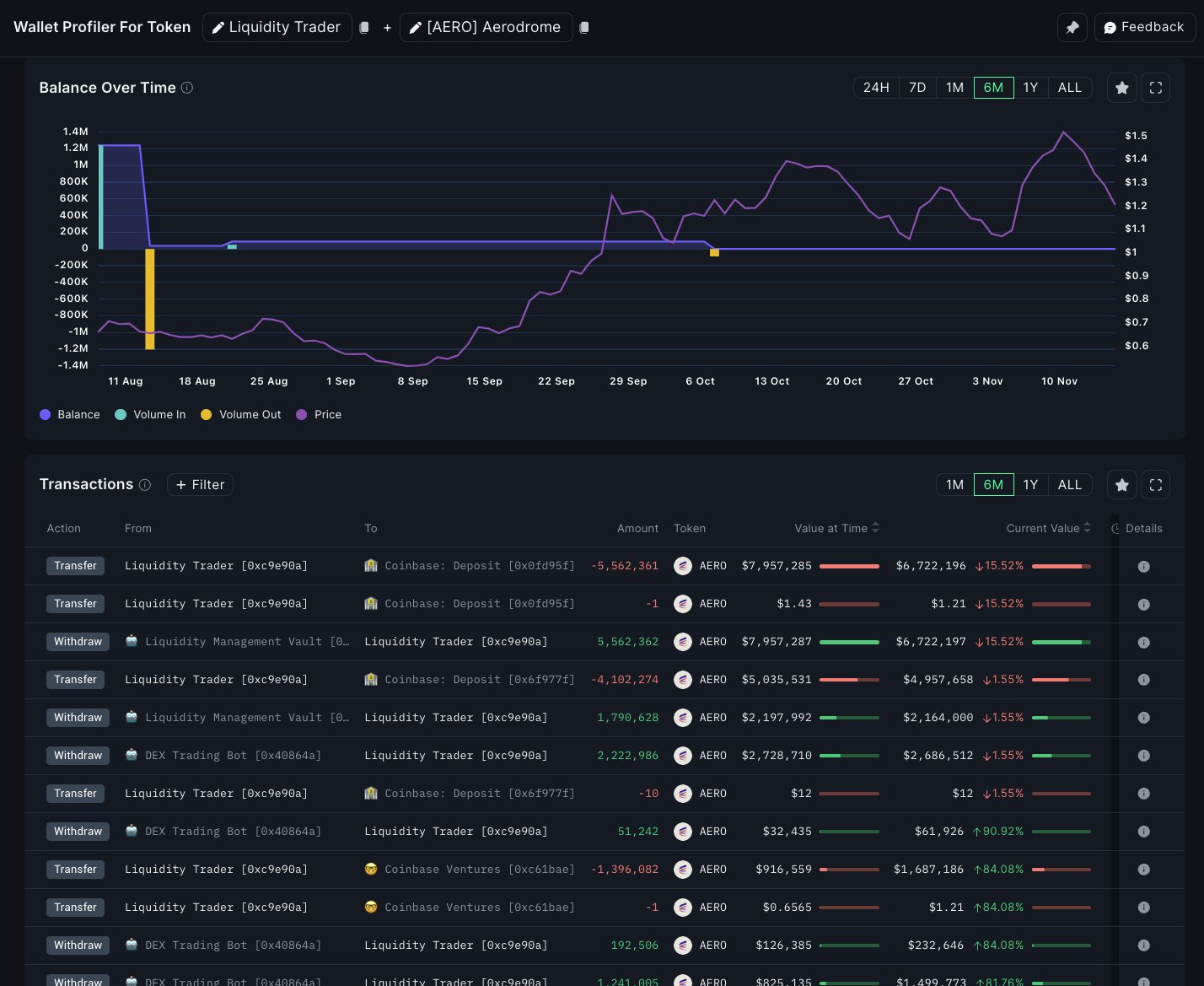

The DeFiance Capital CEO, citing data from the analytics firm Nansen, points out to his 180,800 followers on the social media platform X that Coinbase Ventures has been heavily investing in Aerodrome Finance (AERO).

-->“Coinbase Ventures historically do six-figure venture deals and seldom went beyond $1 million investments until recently. And now we have the largest-ever investment made on a liquid token (>$20 million) bought from the open market like every other market participant. Think about why they are so bullish and still buying more.”

Source: Arthur Cheong/X

Source: Arthur Cheong/XAerodrome Finance is a trading and liquidity marketplace on Base, Coinbase’s Ethereum (ETH) layer-2 scaling solution. The project is a fork of Velodrome, a trading and liquidity marketplace originally launched on Optimism (OP), another Ethereum layer-2 scaler.

Cheong also calls attention to Aerodrome’s rising share of total DEX volume.

“Think about how this will play out in the next three to six months for Aerodrome Finance.”

Source: Arthur Cheong/X

Source: Arthur Cheong/XCheong and Bryan Tan, DeFiance Capital’s head of research, argue in a new analysis that Aerodrome’s total value locked (TVL) could triple and surge to $4 billion within a year, and they think monthly volumes could swell to $50 billion.

TVL refers to the amount of capital deposited within a protocol’s smart contracts and is often used to gauge the health of a crypto ecosystem.

AERO is trading at $1.31 at time of writing. The 118th-ranked crypto asset by market cap is down nearly 1.5 in the past 24 hours.