Bloomberg Intelligence senior macro strategist Mike McGlone thinks the time of large Bitcoin (BTC) pumps is over.

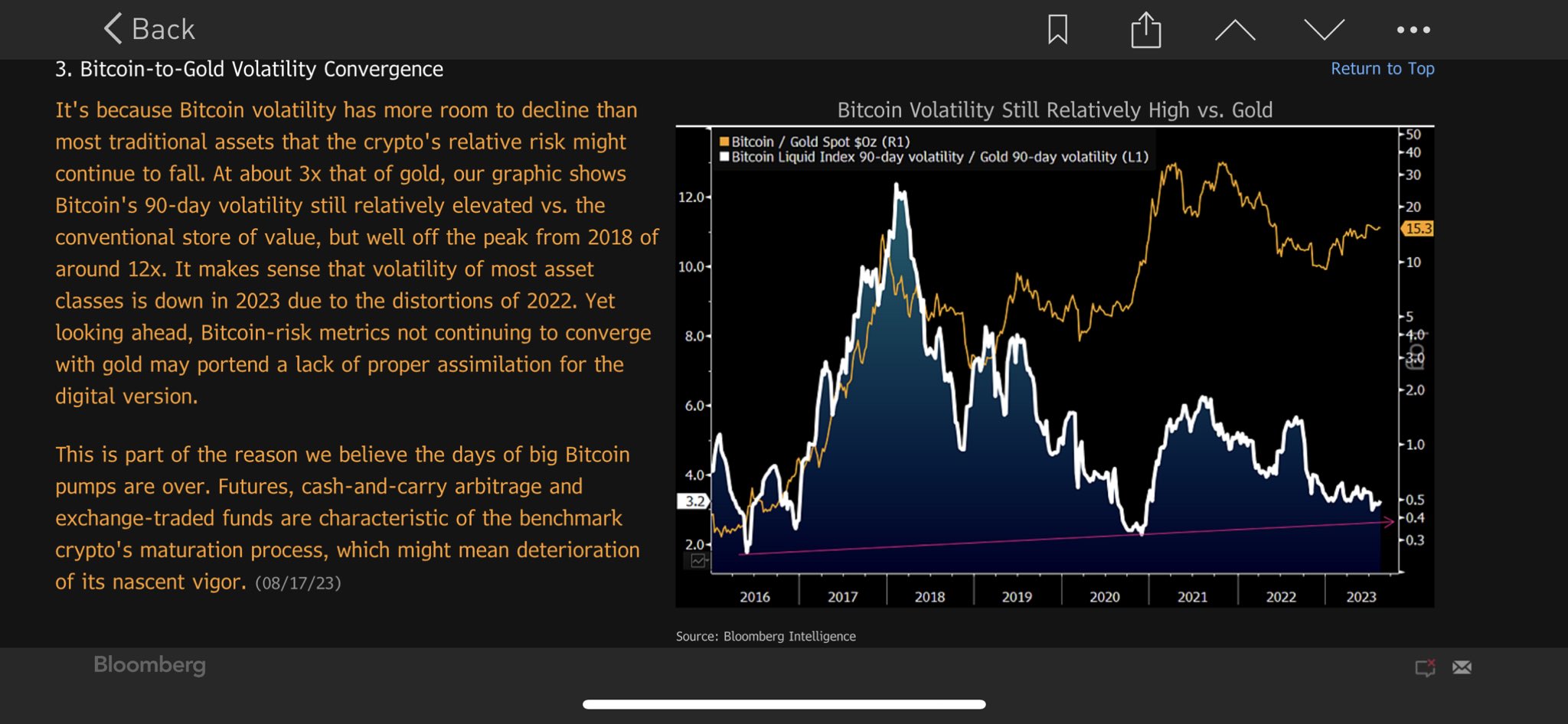

McGlone tells his 59,400 followers on the social media platform X that Bitcoin’s volatility has more room to decline than most traditional assets, which could reduce the top crypto asset’s relative risk.

-->“At about 3x that of gold, my graphic shows Bitcoin’s 90-day volatility still relatively elevated vs. the conventional store of value, but well off the peak from 2018 of around 12x.”

Source: Mike McGlone/X

Source: Mike McGlone/XThe analyst argues that Bitcoin is going through a maturation process and a “deterioration of its nascent vigor.” He also warns that BTC could be facing an elongated retracement period.

“About 10 guaranteed return in two years may change everything – the last time the US Treasury two-year note yielded about 5 was before the financial crisis and birth of Bitcoin, which may portend the headwinds facing most risk assets. My analysis focused on 100-week moving averages shows mostly downward biases, notably vs. the steepest Treasury yield competition in almost two decades.”

Source: Mike McGlone/X

Source: Mike McGlone/XBitcoin is trading at $26,109 at time of writing. The top crypto asset by market cap is down 0.11 in the past 24 hours and more than 11 in the past seven days.