CryptoQuant CEO Ki Young Ju says that Bitcoin (BTC) is currently displaying classic bull market behavior on-chain.

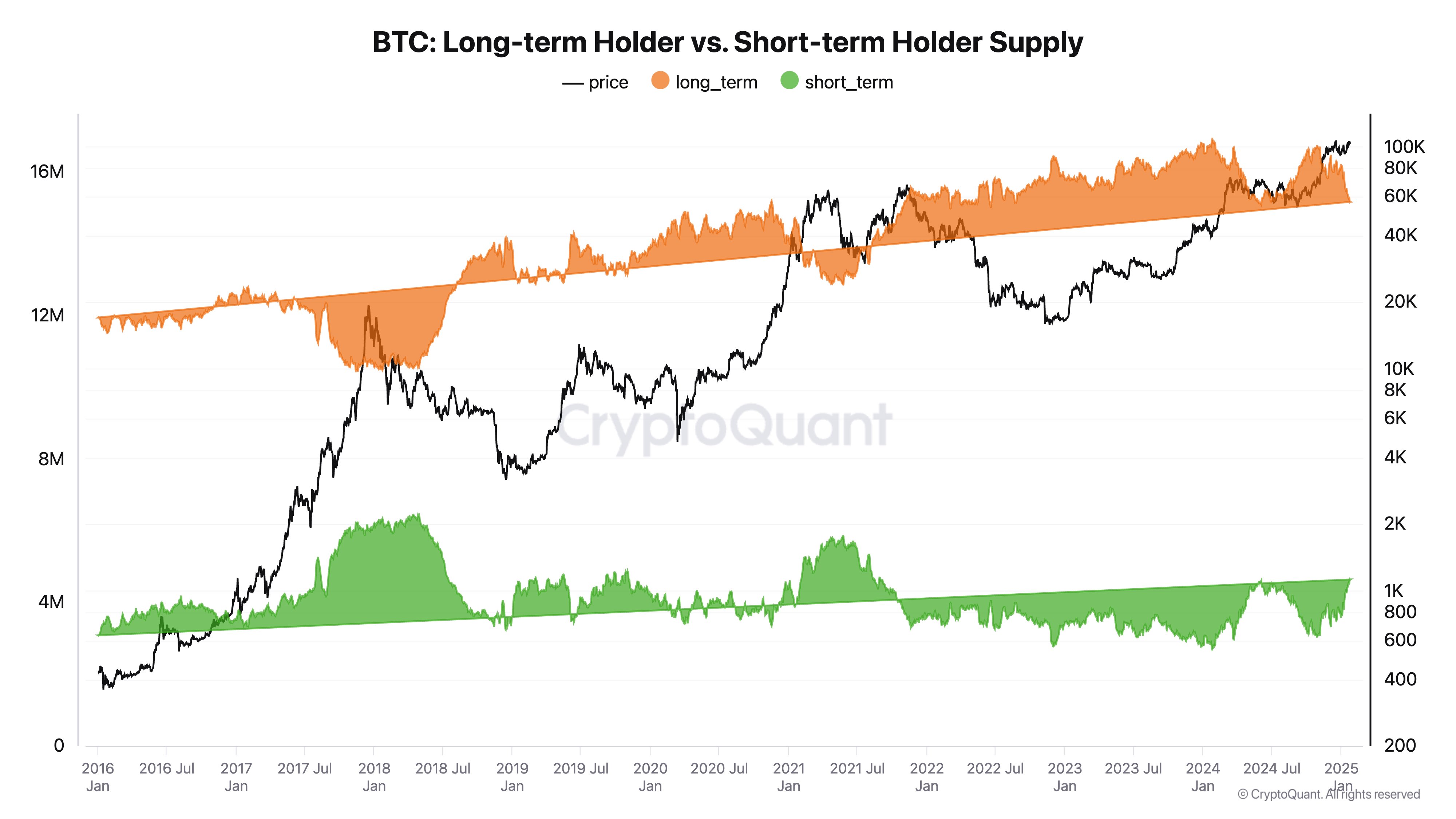

Ki tells his 400,500 followers on the social media platform X that short-term BTC holders are entering the market, scooping up long-term holders’ coins.

-->Short-term BTC holders are investors who have held their coins for less than 155 days while long-term holders are those who have kept their coins inactive for 155 days or more.

According to the chief executive of the analytics firm, the transfer of BTC from long-term to short-term holders is something typically seen in previous bull markets.

“Trump promoted Bitcoin globally.

Short-term holders keep entering, while long-term holders are offloading.

If you know, you know – this is the definition of a bull market.”

Source: Ki Young Ju/X

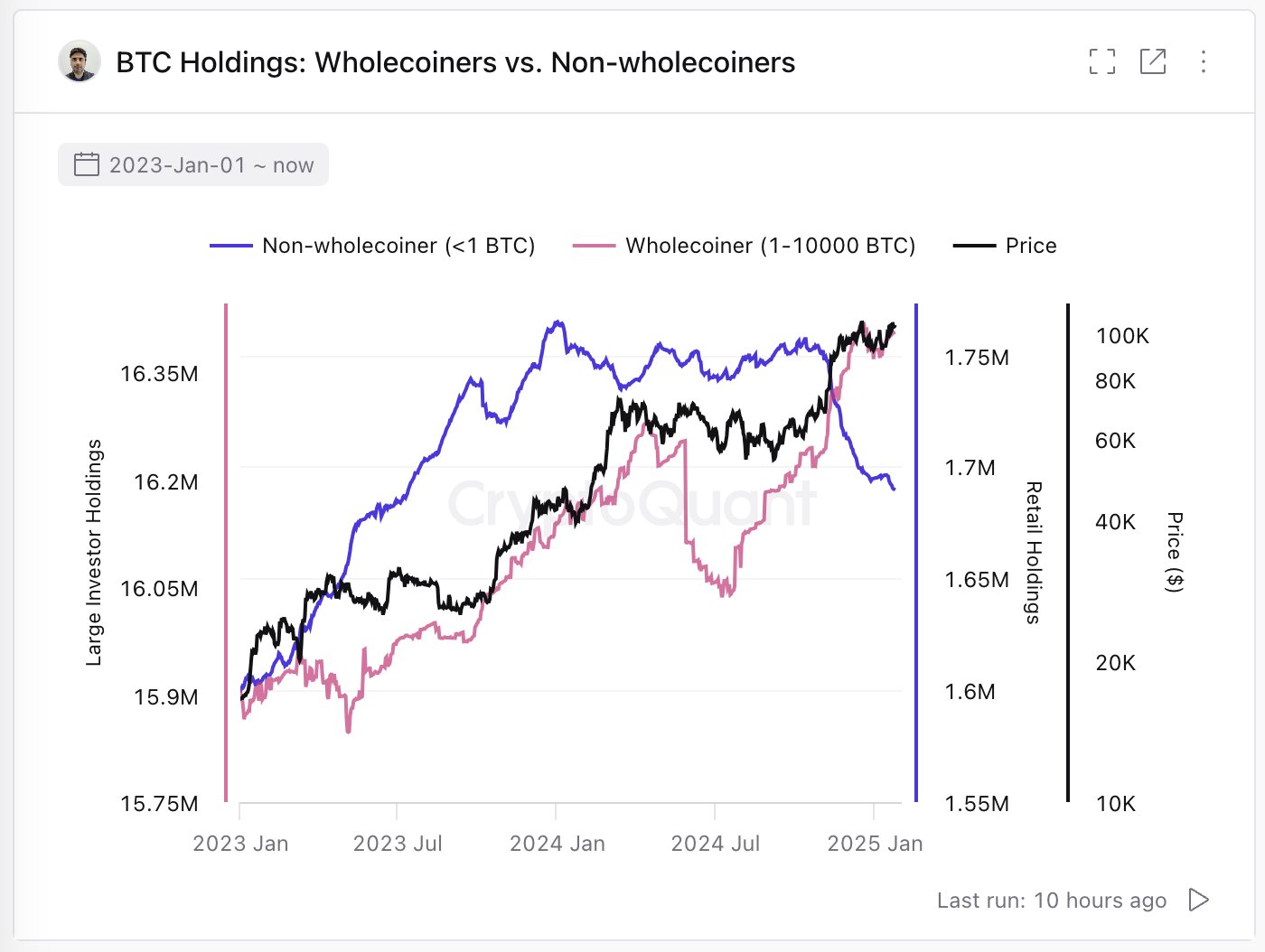

Source: Ki Young Ju/XCiting CryptoQuant data, Ki also says that larger BTC investors with at least one whole coin are gobbling up Bitcoin while smaller entities with less than a coin are offloading.

“Bitcoin retail investors with <1 BTC are selling, while the others with 1 [or more] BTC are buying.”

Source: Ki Young Ju/X

Source: Ki Young Ju/XKi says it’s possible that with President Trump’s “global promotional impact,” the bull run could be extended by “another couple of quarters” longer than usual, perhaps into 2026.

“Typical BTC distribution:

Whales —-> Retail Investors

This cycle:

Retail Investors (OG) + Whales (OG) —-> Retail Investors (Paper Bitcoins) + Whales (Institutions)

———-

OGs leave footprints through on-chain activity and crypto exchanges, while paper Bitcoin (ETFs, corporate stocks) leaves custody wallet on-chain footprints at settlement.

———-

Final phase of distribution:

Retail Investors (OG) + Whales (OG) + Whales (Institutions) —-> Retail Investors (Paper Bitcoins)

———-

I expect this won’t happen until at least mid-year. It might even extend into next year.”

At time of writing, Bitcoin is worth $98,847.