A macro analyst at the investment giant Fidelity thinks there needs to be a sustained spike in money supply to bolster the argument that Bitcoin (BTC) and gold are stores of value that hedge against government-induced inflation.

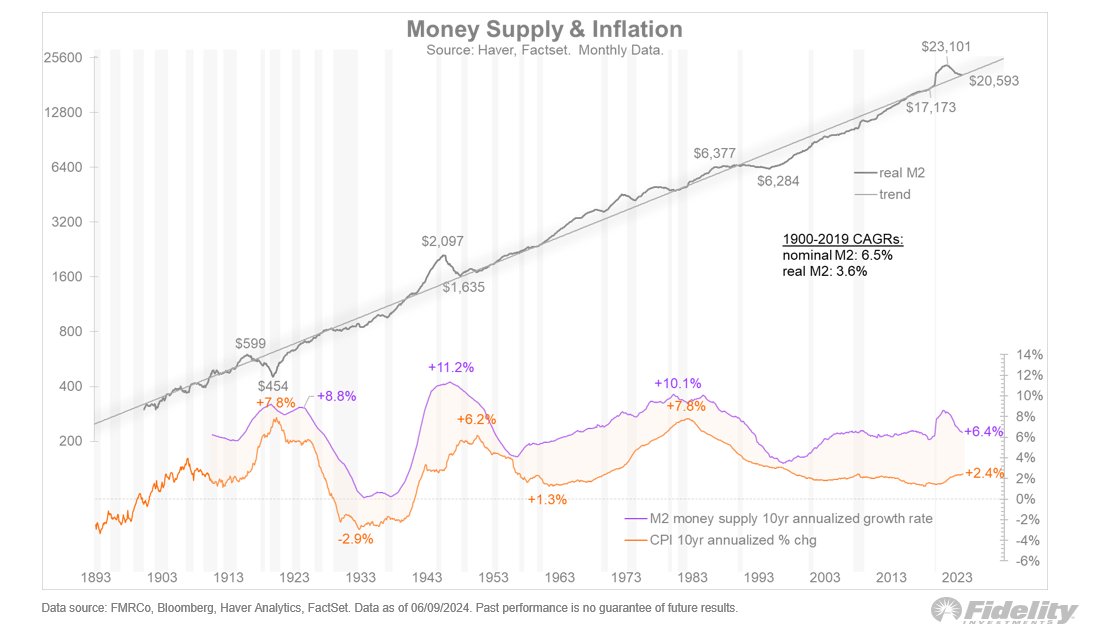

Jurrien Timmer, the director of global macro at Fidelity, notes on the social media platform X that sustained increases in the money supply tend to produce inflation, which gives way to the thesis that gold and BTC can be hedges against weakening money.

-->“My sense is that for the store of value argument to really accelerate, we will need to see sustained above-trend growth in the monetary aggregates. So far, we have not seen that, with the massive spike in real M2 during the pandemic quickly reversing under the weight of a restrictive Fed. That tells me that gold and Bitcoin are a play on something that may happen, but hasn’t happened yet.”

Source: Jurien Timmer/X

Source: Jurien Timmer/XM2 is a money supply metric that measures peoples’ cash, checking accounts and other types of deposits that are easily convertible to cash.

Bitcoin is trading at $68,435 at time of writing. The top-ranked crypto asset by market cap is down nearly 4 in the past seven days.