Investor Tom Lee says that US equities are still in the middle of a bull cycle after completing a normal price correction.

In a new video update for investors on Fundstrat’s YouTube channel, the firm’s chief investment officer says he’s confident that the S&P 500 has already printed its low, but he just isn’t sure if a quick V-shaped recovery like 2020 will play out or if a 2011-style consolidation will unfold.

-->Lee says investors’ interpretation of several risks, such as tariffs and inflation expectations, will likely decide the stock market’s next move.

“I think that we’re still in a bull market. I’m just not clear if it’s a V-shaped recovery like 2020 or it’s a range market like 2011.

Intuitively, I’m going to say that it makes sense that we’ve made a bottom, but we’re maybe range bound for a bit. And that’s because people are worried that there are other shoes to drop. The tariff war with China could turn into a cold war. Investors are going to worry about the ripple effects of this shock, leading to a global recession. These are extreme views, by the way.

[Or] that some people are going to worry about a financial crisis from all this deleveraging, and that inflation expectations could surge to an extent that we get ‘greedflation.’ That’s where companies are basically raising prices, and it’s going to force the Fed to hike. And of course, if estimates fall more than 20, stocks have downside because the stock market already had a 20 drawdown.”

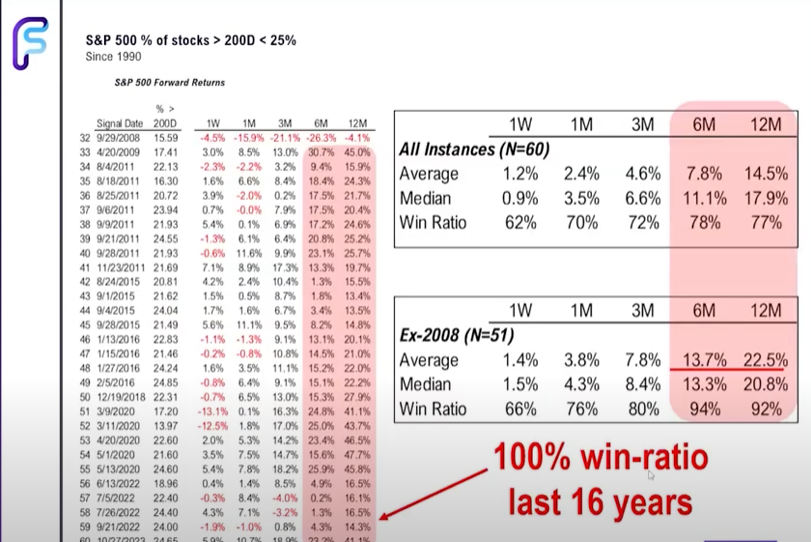

Lee shares a chart showing that only 6 of stocks in the S&P 500 are above their 50-day moving average, and just 19 are above their 200-day moving average. The investor says that historically, the setup has had high win rates for bulls.

“This is the percentage of stocks above the 50-day moving average at the top, and above the 200-day moving average on the bottom. Below 20 is a big deal, because over the last 16 years, the S&P was higher six months and 12 months later. In fact, if you look at three months later, outside of 2022, the stock market was higher three months later every single time, so I think we did make a structural low.”

Source: Fundstrat/YouTube

Source: Fundstrat/YouTubeAs of Friday’s close, the S&P 500 is trading at 5,282 points.