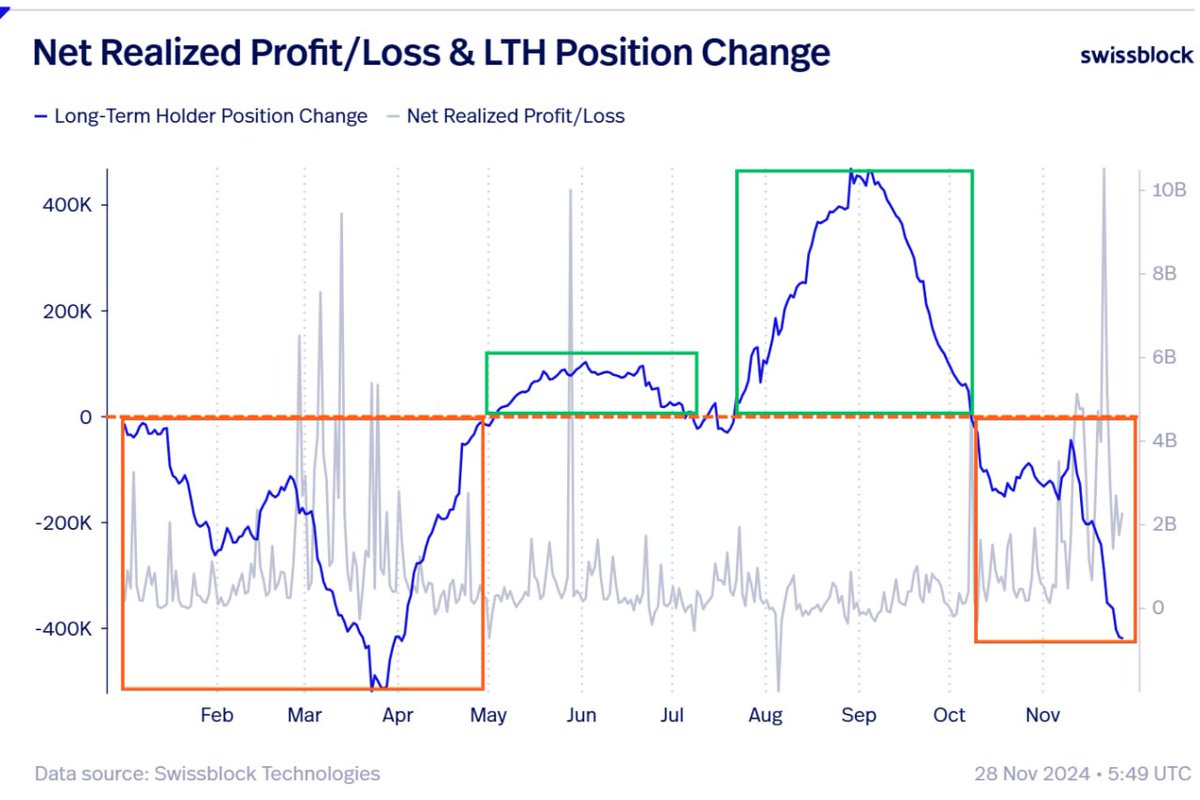

The co-founders of the crypto analytics platform Glassnode believe that Bitcoin (BTC) may start heading higher after retracing to the low $90,000s based on one metric.

Jan Happel and Yann Allemann, who go by the handle Negentropic, tell their 63,200 followers on the social media platform X that Bitcoin’s correction may be over after long-term holders (LTHs) sold less than in the first quarter of the year.

-->LTHs are addresses that hold coins for at least 155 days and they tend to exit the market when BTC makes a bull run.

“Long-term holders have taken profits near $100,000, but not as aggressively as in Q1. The lack of continuous realized profit spikes suggests fewer LTHs exited during this correction – possibly signaling we’ve already hit the bottom.”

Source: Negentropic/X

Source: Negentropic/XBitcoin is trading for $96,726 at time of writing.

Next up, the analysts are suddenly turning bullish on the artificial intelligence (AI)-based crypto project the Artificial Superintelligence Alliance (FET).

“When Bitcoin corrects in an uptrend, we use the three-factor authentication (3FA) checklist for altcoin opportunities:

- Strong fundamentals and part of a narrative with traction.

- Relative Strength Index (RSI) is neutral (weekly/daily).

- Price hasn’t exploded, still in accumulation.

FET checks all boxes, compressing since July. Accumulate at range lows for efficient dollar-cost averaging!”

Source: Negentropic/X

Source: Negentropic/XFET is trading for $1.62 at time of writing, up 8.1 in the last 24 hours.