Ethereum (ETH) has a flurry of potentially bullish catalysts this year, according to Ki Young Ju, the chief executive of the digital asset analytics platform CryptoQuant.

Young Ju notes on the social media platform X that there is no significant sell pressure following last week’s record-shattering Bybit hack.

-->“On-chain and market data remain neutral. Exchange selling takes time, and OTC (over-the-counter) offloads barely affect the price.”

The CryptoQuant CEO points out that Ethereum currently holds 56 of the stablecoin market cap.

“With Trump easing crypto regs, more firms may use ETH-based stablecoins and smart contracts in 2025.”

He also says it’s bullish that ETH already has approved and active spot exchange-traded funds (ETFs) in the US.

“Regulatory tailwinds could trigger a ‘Large Cap ETF altseason,’ boosting ETH this year.”

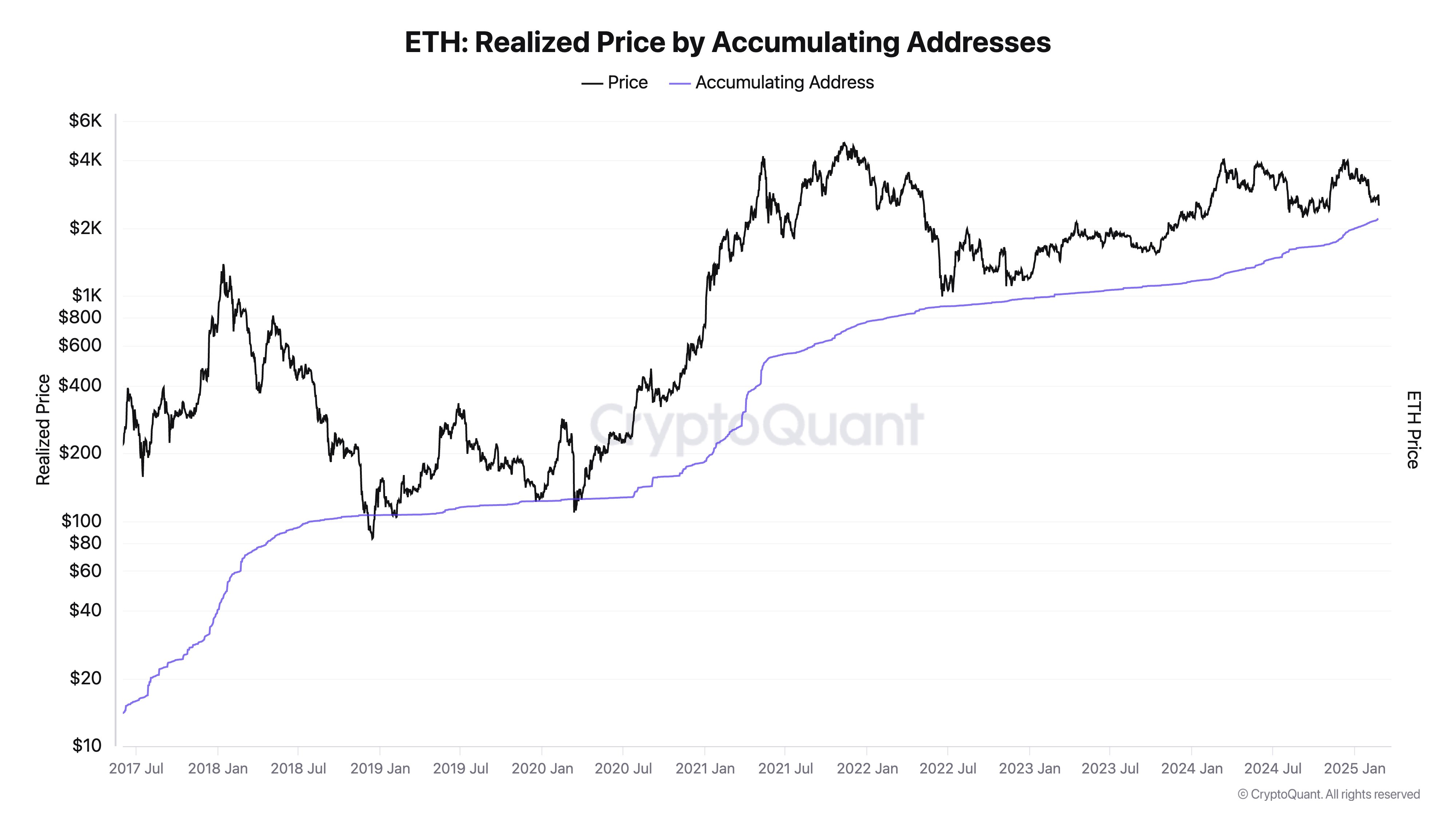

Lastly, Young Ju notes that whales have been accumulating Ethereum, another potentially bullish sign.

“10,000–100,000 ETH wallet balances are up 24 over the past year, mainly from wallets under 1,000 ETH. The current price is nearing the cost basis of accumulating addresses.”

Source: Ki Young Ju/X

Source: Ki Young Ju/XEthereum is trading at $2,424 at time of writing. The second-largest crypto asset by market cap is down nearly 9 in the past 24 hours and nearly 8 in the past seven days.