JPMorgan Chase is among the most expensive US bank stocks, along with one trillion-dollar lender that Warren Buffett’s firm has reduced its position in, according to a new report.

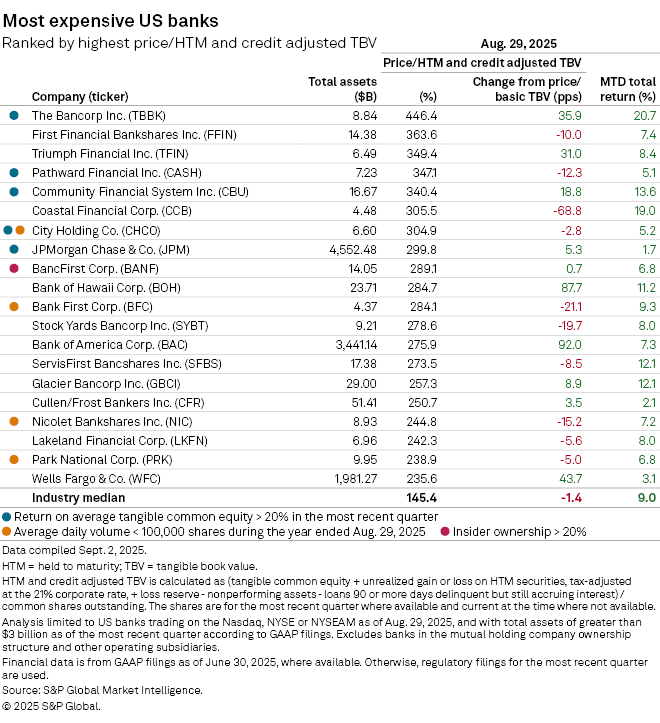

In a September financial update, S&P Global says that JPMorgan Chase comes in at the 8th most expensive bank stock, while Bank of America comes in at the 13th most expensive bank stock, out of the 210 banks analyzed.

-->According to S&P Global, nearly all of the US banking sector stocks increased in the month of August.

Analysts highlighted two areas where JPMorgan and Bank of America are performing well.

“No. 8 JPMorgan and No. 13 Bank of America Corp. flexed their lending power in the second quarter, prompting analysts to increase full-year 2025 loan growth estimates for the banks. Both banks also topped investment banking fee estimates.”

The bank rankings are based on the adjusted tangible book value calculated by the “sum of tangible common equity, loss reserves and unrealized gain or loss from held-to-maturity securities, tax-adjusted at the 21 corporate rate, less nonperforming assets and loans 90 or more days past due but still accruing interest, divided by common shares outstanding.”

Source: S&P Global

Source: S&P GlobalRecent filings with the U.S. Securities and Exchange Commission (SEC) show Buffett’s Berkshire Hathaway unloaded 26,306,156 shares in Bank of America for around $47.57 per share in the second quarter of the year.

The firm sold 48.7 million Bank of America shares in Q1, worth about $2.19 billion. Berkshire Hathaway now holds 605.26 million shares in Bank of America worth $28.6 billion.