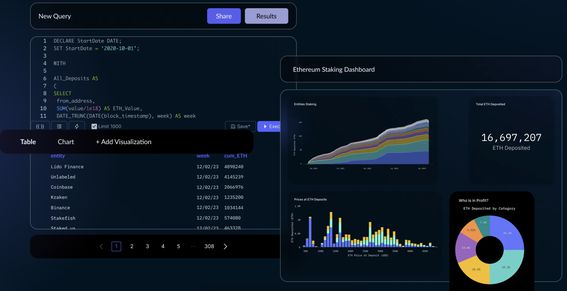

Nansen, a blockchain data analytics firm, has launched Nansen Query, a platform that allows clients to programmatically access unique, curated datasets pulled from Nansen’s databases, according to a Wednesday press release.

The new product aims to help firms perform blockchain analyses more efficiently by demystifying on-chain transaction history and pricing data. It promises to offer users a complete overview of markets to value “up to 60 times faster than competitors,” according to the press release.

The product provides coverage for 95 of all on-chain Total Value Locked (TVL) asset data and 98 of stablecoin deposit data across 17 blockchains, including Ethereum, Polygon, Arbitrum, BNB Chain, Avalanche, Optimism, Ronin and Solana.

Nansen Query differs from Nansen’s base-level offering by pairing data with the company’s proprietary and trading indicators like the “wash trading filter,” which helps identify suspicious on-chain activity by scanning trades between several linked wallets and transactions bounced between various trading counterparties.

Nansen’s labeling system achieves that aim by facilitating firms’ analyses of on-chain data, which, while recorded on a public ledger system, can sometimes be difficult to access, Andrew Thurman, an analyst at Nansen, tells CoinDesk.

"Actually getting to useful data is difficult given the scale of blockchain data and the ways in which you need to parse it to access the most useful information," said Thurman. "We help people do that."

A query is a request for data from a database or a request for action on that data that allows users to edit large information sets and identify trends among them. A programming language, like SQL, is used to create a query.

Nansen’s data analytics tools, launched in 2019, have gained traction among firms throughout the cryptocurrency industry, including prominent players like Coinbase, OpenSea, MakerDAO, Polygon, Avalanche and a16z.