A widely followed crypto analyst says that exponential currency debasement is carrying Bitcoin (BTC) to new heights.

In a new thread on X, pseudonymous crypto trader PlanB tells his 2.1 million followers that all asset prices – including gold, the crypto king, and the S&P 500 – have been rising during the last 10 years due to the Fed printing money.

-->“How will there be diminishing returns when debasement is exponential? All asset prices increased exponentially last 10 years (driven by money printing): -Gold 3x (~$1,000 to ~$3,000) -S&P 3x (~$2,000 to ~$6,000) -Bitcoin 250x (~$400 to ~$100,000). In my opinion, it is a unit of account phenomenon.”

Source: PlanB/X

Source: PlanB/XPlanB goes on to note that BTC will continue to rise until the end of the year as evidenced by the vast difference between its August closing price and its 200-week moving average. He also notes that the relative strength index (RSI), an indicator that measures an asset’s momentum, is hovering in bullish territory.

“Bitcoin’s August closing price: $108,269. 200-week moving average: $52,000 and rising. Realized cost price: $52,000 and rising. 14-minute RSI (color overlay): 67 (uptrend) Bull market continues.”

The analyst concludes by saying that the flagship digital asset will always go up as it represents the separation of money and state.

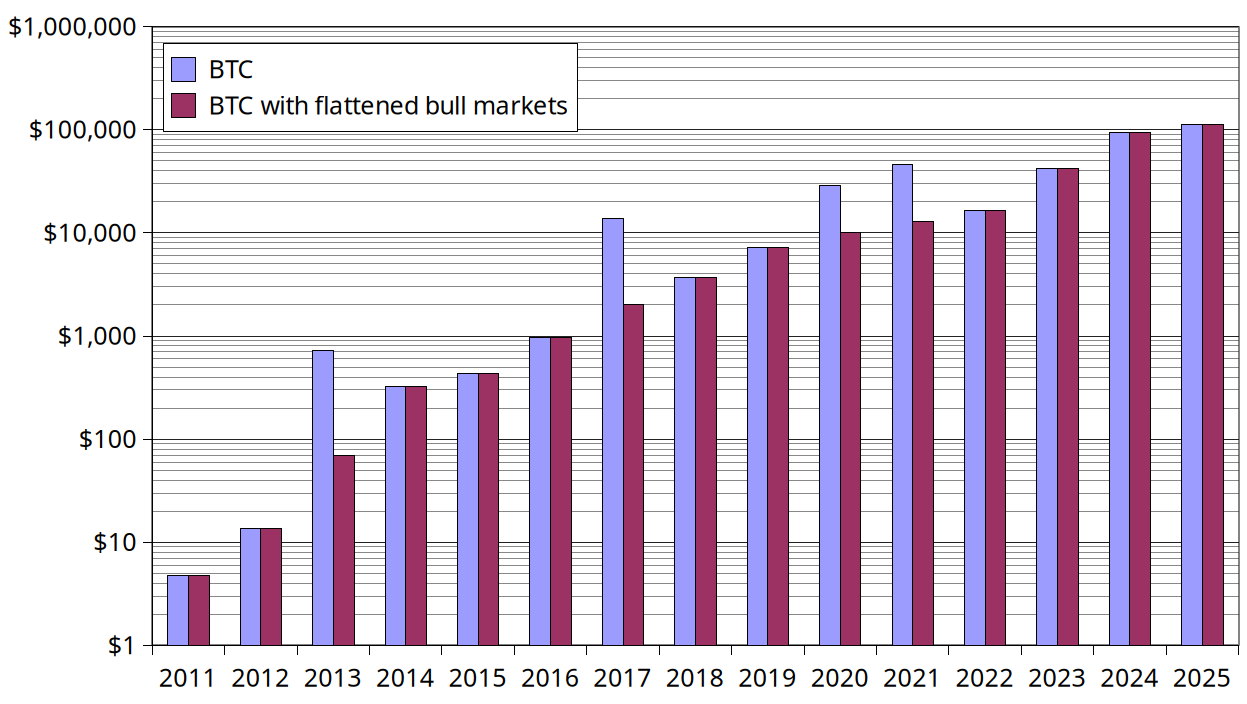

“Bitcoin ALWAYS goes up… if you ignore/flatten the bull markets (2013, 2017, 2020/2021). Forget about bull markets, all-time highs (ATH) and timing the tops. Focus on the big picture: you are watching the separation of money and State, the birth of the best money/asset ever.”

Source: PlanB/X

Source: PlanB/XLast month, PlanB predicted that the top crypto asset by market cap would reach a price tag of $300,000 by 2026.

Bitcoin is trading for $111,171 at time of writing, a fractional increase on the day.

Follow us on X, Facebook and Telegram