Liquidity across crypto exchanges has surged this year, according to the digital asset analytics firm Kaiko.

Kaiko notes in a new analysis that an increase in trading volume and improving sentiment drove that jump in liquidity, which has been particularly prevalent for Bitcoin (BTC) markets in the US.

-->“The approval of spot BTC ETFs in the US this year has likely contributed to the increase, as more institutional firms participate in the market. US exchanges now account for over 60 of BTC’s 1 market depth, up from around 45 at the beginning of 2023.”

Source: Kaiko Research

Source: Kaiko ResearchThe analytics firm also notes that Bitcoin dominance relative to altcoins has jumped on US exchanges but reduced on offshore markets.

“Historically, BTC dominance has been higher on US platforms due to higher institutional participation in the US, with traders preferring BTC over riskier altcoins. Interestingly, despite BTC’s price decline in Q2, BTC’s share on US markets continued increasing, suggesting that the launch of spot ETFs could further exacerbate this trend.”

Source: Kaiko Research

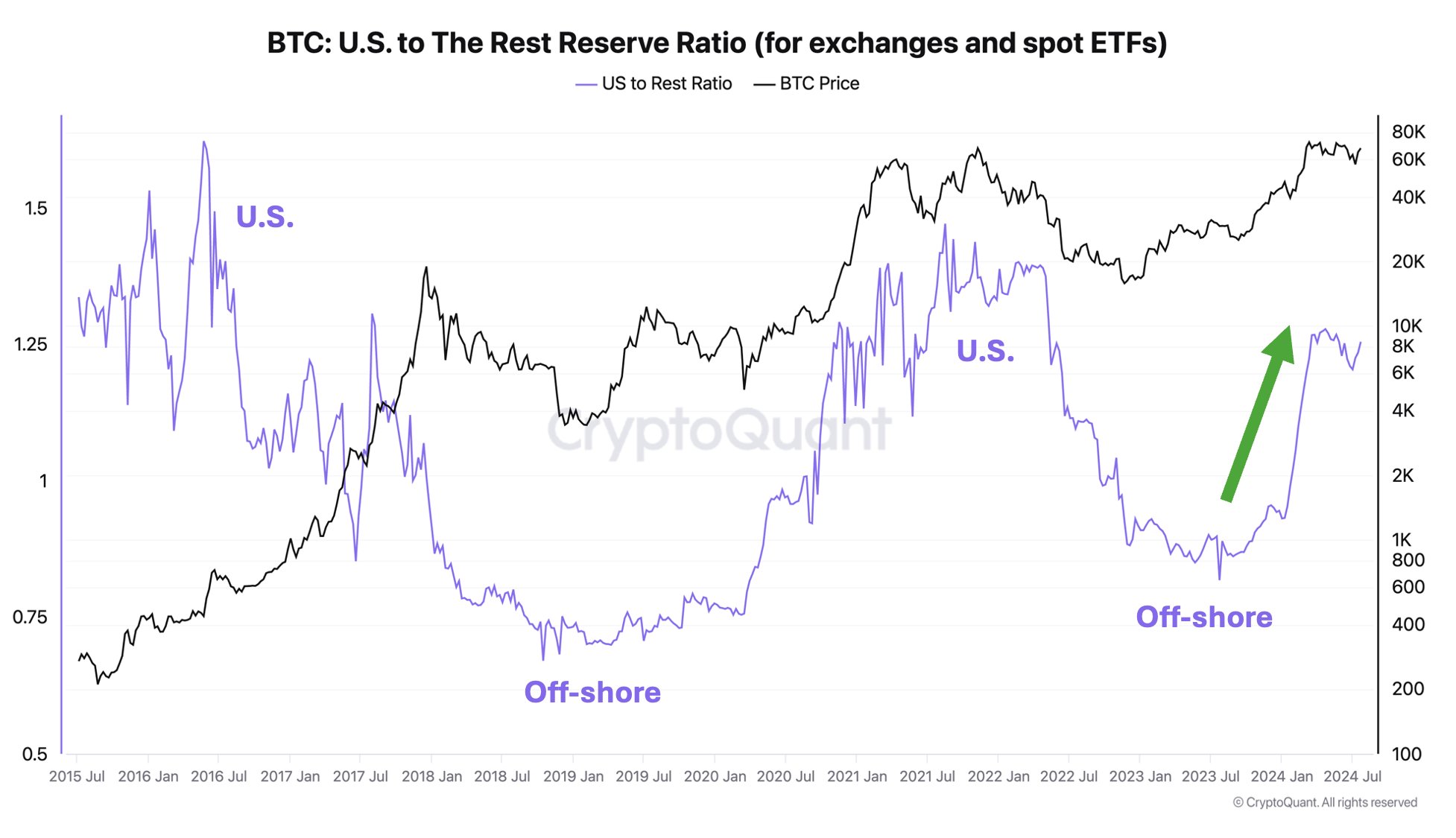

Source: Kaiko ResearchKaiko isn’t the only firm to highlight this trend: Ki Young Ju, the chief executive of the analytics platform CryptoQuant, recently noted on the social media platform X that Bitcoin is entering the US.

Source: Ki Young Ju/X

Source: Ki Young Ju/XBTC is trading at $66,381 at time of writing.