On-chain analyst Willy Woo says Bitcoin could hit the $125,000 mark at a “minimum” this year if financial giants BlackRock and Fidelity allocate relatively conservative amounts of capital.

Woo tells his 1 million followers on the social media platform X that if clients of the two firms decide to rotate 3 of assets to Bitcoin, BTC can easily hit the $2.5 trillion market cap level.

-->“BTC price will go past $125k minimum before the end of 2025 just from Blackrock and Fidelity clients if they rotate 3 exposure to #Bitcoin.

These are their most optimistic portfolio allocation recommendations:

Blackrock ($9.1T): 84.9

Fidelity ($4.2T): 3”

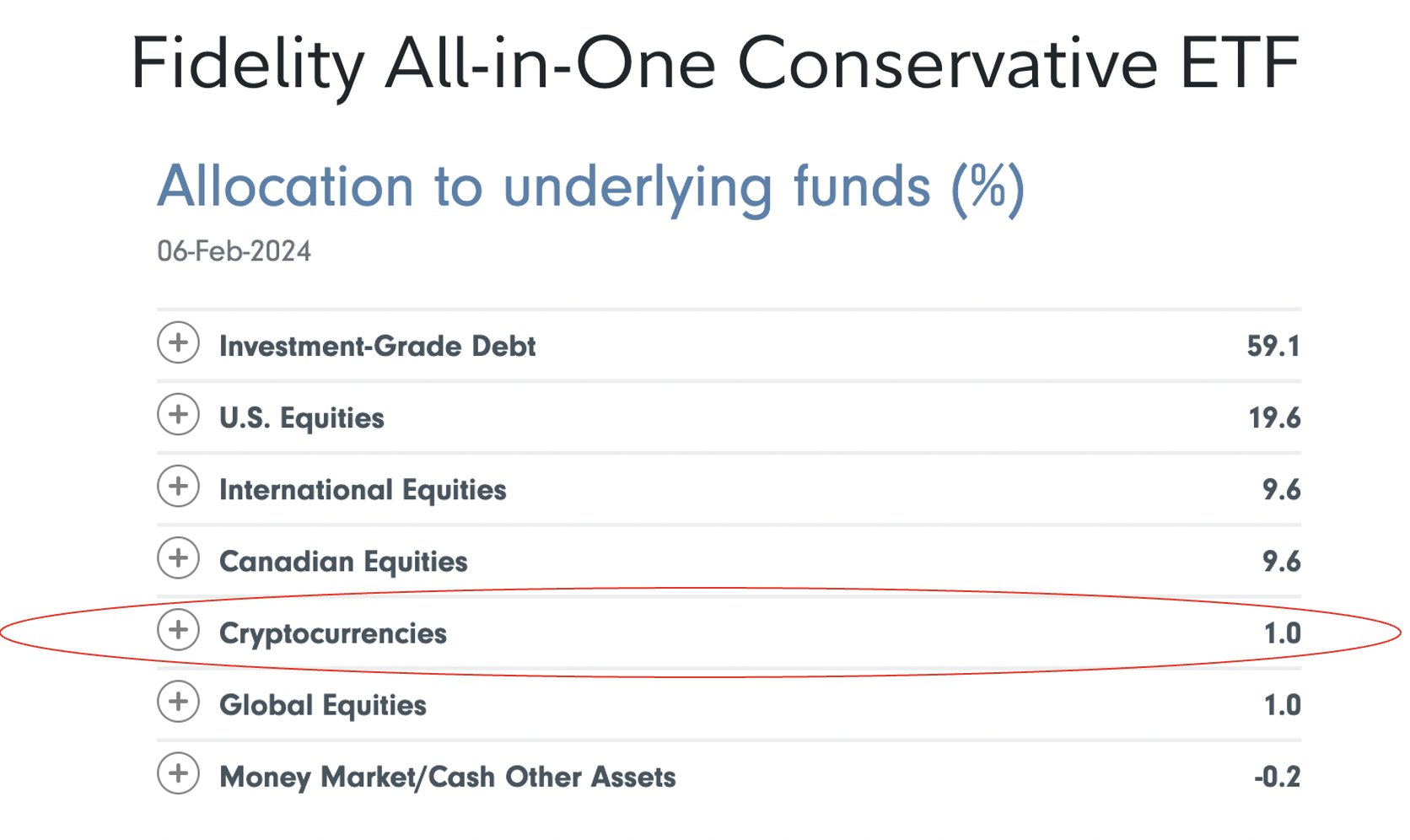

Recently, Fidelity’s Canadian subsidiary revealed a 1-3 allocation to crypto assets in its “Fidelity All-in-One Conservative ETF” which currently has just under $200 million in net assets under management.

Bitwise CIO Matt Hougan commented on the ETF, saying,

“Fidelity has a 1-3 bitcoin allocation in their ‘All-in-One’ asset allocation funds in Canada, using spot bitcoin ETFs. The “Conservative” version is posted below.

When and if this becomes the norm for portfolios in the US, wow…”

Source: Matt Hougan/X

Source: Matt Hougan/XAccording to Woo, the $125,000 price target is still conservative given that Fidelity and Blackrock’s assets are still only a small portion of the available global wealth.

“Very conservative as it’s only $13.3T of global wealth accounted for. There’s $500T out there, presumably quite a bit of this comes on because of this validation from the largest asset managers.”

At time of writing, Bitcoin is trading at $66,504, up $67,222.