Tags: Luna

- news

- news

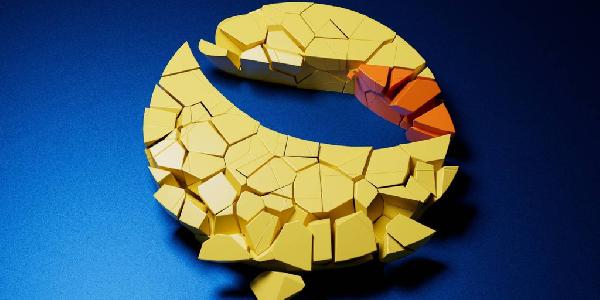

The Co-Founder and former CEO of the defunct blockchain protocol admits to schemes that cost investors and users billions.

33 - news

Managed by administrators at New York-based Kroll, the portal will open on Monday, March 31 and close on April 30.

133 - news

- news

The claims process requires proof of ownership, with on-chain verification preferred over manual submissions to avoid delays or rejections.

140 - news

The New York Attorney General and Galaxy Digital have agreed to a settlement over the firm‘s handling of LUNA before its 2022 collapse.

88 - news

- news

Terra founder Do Kwon‘s criminal trial has been set. Here‘s what you need to know about the $40 billion collapse of TerraUSD and LUNA.

107 - news

- news

- news

Court documents allege that Do Kwon‘s crypto ecosystem Terra may have affected over a million victims when UST and LUNA collapsed in 2022.

106 - news

Do Kwon faces U.S. criminal charges as prosecutors allege his Terra ecosystem misled investors, causing over $40 billion in losses.

100 - news

Kwon now faces nine charges, including commodities fraud and money laundering conspiracy, instead of the eight counts he was previously charged with.

161 - news

Freshly extradited from Montenegro, Terraform Labs co-founder Do Kwon pleaded not guilty to U.S. criminal charges over Terra‘s collapse.

131 - news

- news

- news

Terraform Labs co-founder Do Kwon had been held in Montenegro since his March 2023 arrest at Podgorica airport.

108 - news

- news

The SEC and Terraform Labs reached a $4.47 billion penalty, thereby settling charges over the collapse of TerraUSD and Luna tokens.

107 - news

Director Harry Hyun said the movie will portray “the reality of young people who are addicted to stocks during the day and coin speculation at night.”

152 - news

More than half of the SEC’s recoveries came from crypto, mainly the $4.5 billion settlement in the Terraform Labs case.

134 - news

- news

The approval marks the final step in Terraform’s Chapter 11 bankruptcy proceedings.

154 - news

The company behind TerraUSD and Luna could shell out up to $442 million to investors.

119