Legislators need to educate themselves on Web3 if they care about protecting consumers, Steven Eisenhauer, chief risk and compliance officer at Ramp, writes.

Legislators need to educate themselves on Web3 if they care about protecting consumers, Steven Eisenhauer, chief risk and compliance officer at Ramp, writes.

Crypto, rather than "blowing up" traditional finance, is making the existing system more efficient.

If the past year of enforcement actions shows anything, it‘s that financial regulators do not need updated rules to investigate and prosecute crime in crypto.

Users will likely demand cash-like privacy protections for central bank digital currencies, which may be thwarted by regulations. However, new technology solutions may enable high degrees of privacy while complying with regulations.

Crypto‘s three pillars of ownership, control and interoperability are likely to resonate with policymakers the most, writes Josh Rosenblatt of Co:Create.

With tight regulations already in place that helped insulate FTX Japan and its investors from heavy losses, Japan is working on policy and guidelines for stablecoins, NFTs and DAOs as it welcomes a crypto future.

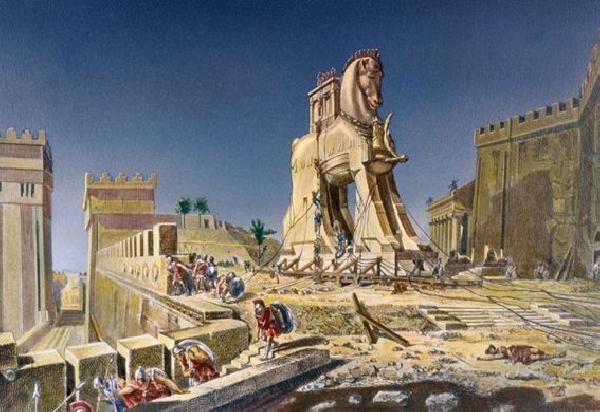

Maybe Congress should separate custody from exchange, the way it severed Wall Street from commercial banking nearly a century ago. This piece is part of CoinDesk’s Policy Week.

The 300 members of South Korea’s National Assembly are currently considering 17 separate crypto-related proposals, from which they hope to shape the Digital Asset Basic Act.

Crypto assets cannot function as they‘re designed to – while being securities, Lewis Cohen, co-founder of DLx Law, writes.

Several regulatory initiatives are underway to expand oversight of this nascent industry, the former head of fintech at the U.K. Financial Conduct Authority writes.

Crypto services may need to look more like the institutions regulators are already familiar with. Rather than saying they deserve to be part of the financial system, they’ll need to show it.

Asia’s biggest financial centers seem eager to encourage the growth of the crypto industry while protecting consumers and preventing contagion if things go wrong.

At the intersection of crypto and climate activism, the business community is seeking the power of regulation to spur adoption and action, writes sustainability advocate Boyd Cohen.

Let‘s face it, a lot of crypto trading is more like gambling than investing. So why not regulate the industry that way? JP Koning says there are benefits and demerits to the idea.

The BSA’s surveillance framework is ingrained within U.S. regulators’ compliance culture – but it doesn‘t work for crypto.

Successfully implementing self-regulation in the blockchain ecosystem is imperative, no matter what decisions and laws external forces might make, says Miguel Morel, founder and CEO of blockchain analytics company Arkham Intelligence.

Crypto policy efforts would make great TV, Ron Hammond, director of government relations for the Blockchain Association, writes.

Mike Belshe, CEO of BitGo, makes the case to improve oversight of stablecoin reserves, separate trading and custody accounts and minimizing the use of "omnibus wallets."

Adapting how crypto exchanges operate under the new regulation won’t be easy, but it might make it easier for them to get bank accounts in Europe.

As this year‘s president of the intergovernmental forum, India can dictate how developed countries think about the future of crypto regulation, says CoinDesk‘s Amitoj Singh.

What can the United States learn from regulation around the world? Jeff Wilser takes a grand tour.

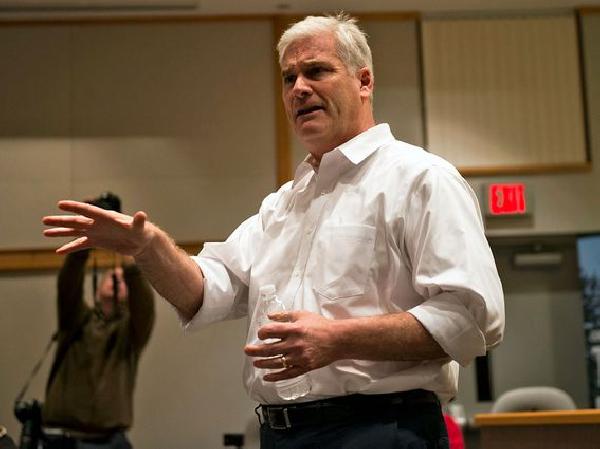

The House Whip (a.k.a. the “Crypto King of Congress”) blames over-centralization and old-fashioned fraud for FTX’s collapse, not crypto. As federal legislators consider new crypto legislation, can he persuade his colleagues of the same?

U.S. lawmakers must prevent the further erosion of our privacy rights by defending our right to use privacy-preserving tech and passing laws against unreasonable and constant digital surveillance.