A closely followed crypto strategist believes that the Bitcoin (BTC) bull market will endure another year or so based on historical precedent.

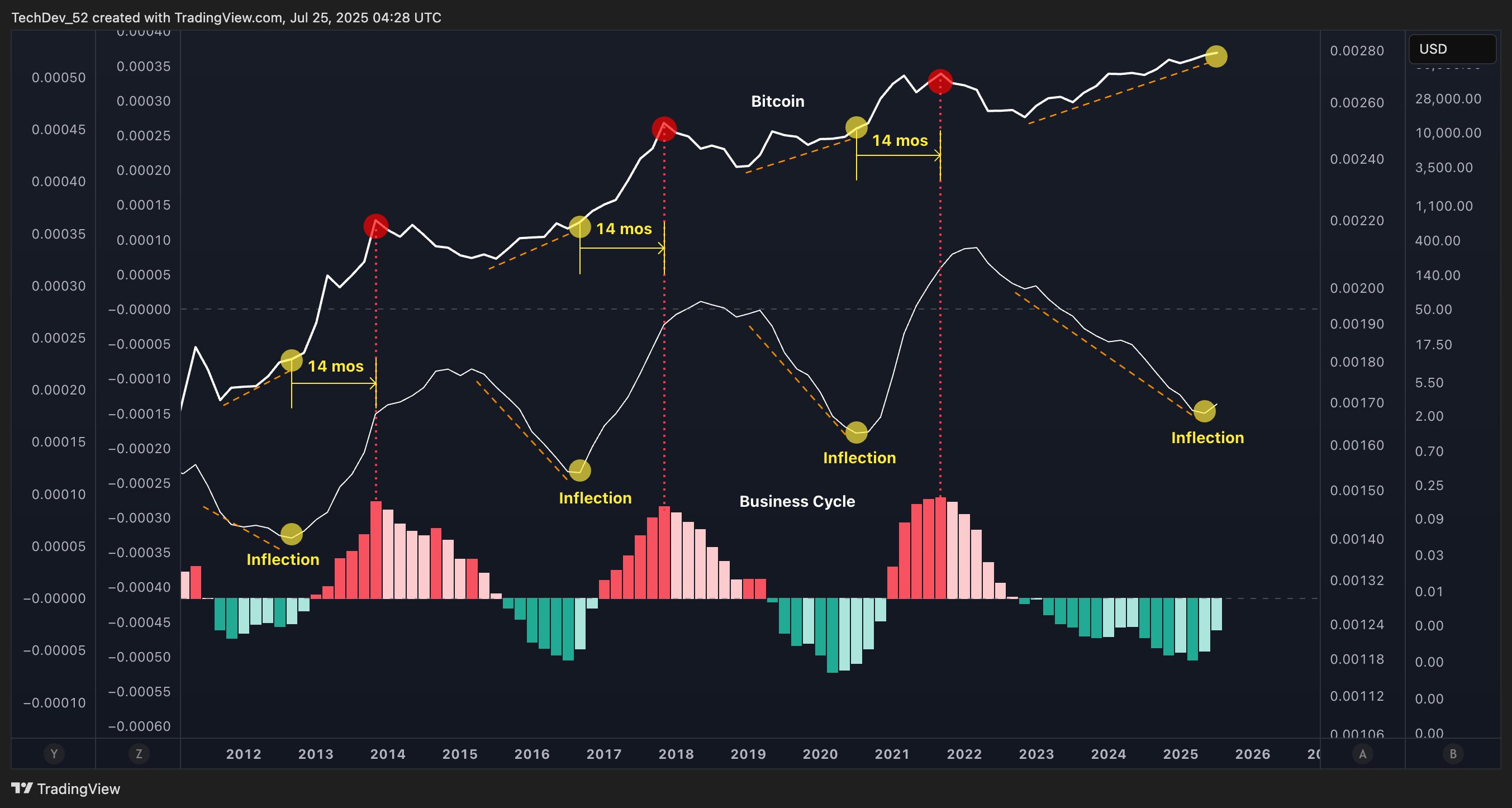

Pseudonymous analyst TechDev tells his 537,900 followers on the social media platform X that he thinks Bitcoin follows the business cycle, or the ebb and flow of macroeconomic activity, rather than the four-year halving cycle.

-->According to the analyst, Bitcoin tends to rally hard when the business cycle begins a new uptrend, while the copper-to-gold ratio – a risk-appetite indicator –bottoms out.

Taken together, TechDev says the signal marks an “inflection point” that has historically aligned with the timing of Bitcoin bull market tops.

“There is a Bitcoin cycle – just not what many think.

It mirrors the business cycle.

Bitcoin tops when it tops.

Bitcoin goes parabolic when it inflects.

Bitcoin’s ‘ramp’ length = time until inflection

Bitcoin has always topped 14 months after inflection.”

Source: TechDev/X

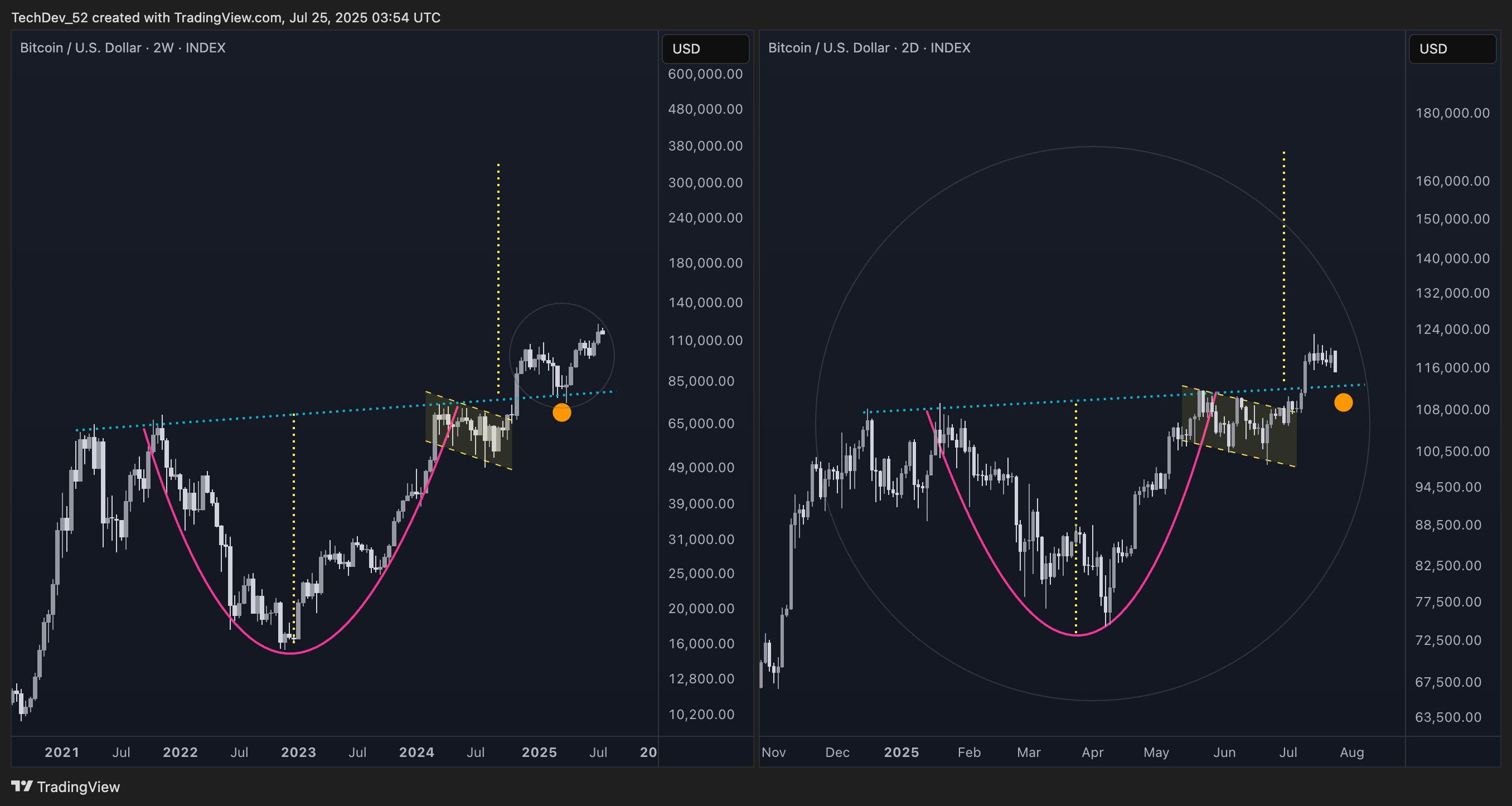

Source: TechDev/XAs for his Bitcoin price targets, TechDev sees BTC hitting $170,000 in the short to mid term and about $380,000 in the long term. His predictions are based on BTC’s two-day and two-week charts, which show that Bitcoin broke out from massive cup-and-handle patterns on both time frames.

The cup-and-handle pattern suggests that a bullish asset will continue its uptrend after a period of consolidation.

“We literally just did this.”

Source: TechDev/X

Source: TechDev/XAt time of writing, Bitcoin is worth $118,110.