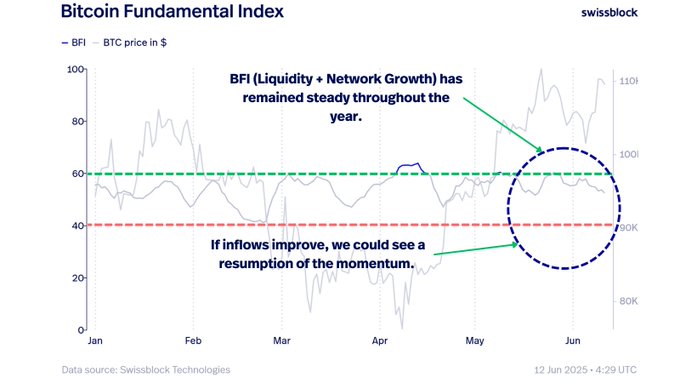

Analytics platform Swissblock is outlining the path forward for Bitcoin (BTC) amid stiff resistance at a level just below the all-time high.

According to Swissblock, Bitcoin is “stalling below $110,000” and the upward trend is now under pressure as a broad trading range appears to form between the resistance level and a price of $100,000.

-->“Consolidation may last, but one thing’s clear: No breakout without strong fundamentals.”

Source: Swissblock/X

Source: Swissblock/XBitcoin is trading at $104,447 at time of writing, around 7 below the all-time high of just under $112,000 reached last month.

Earlier in the week, Swissblock had warned that a failure by Bitcoin to break out amid a lack of fresh investor flows could lead to a double-top.

A double-top is an extremely bearish technical reversal pattern formed when the price of an asset forms two consecutive peaks, an indication that there’s a strong resistance level that the price is unable to pierce through.

Source: Swissblock/X

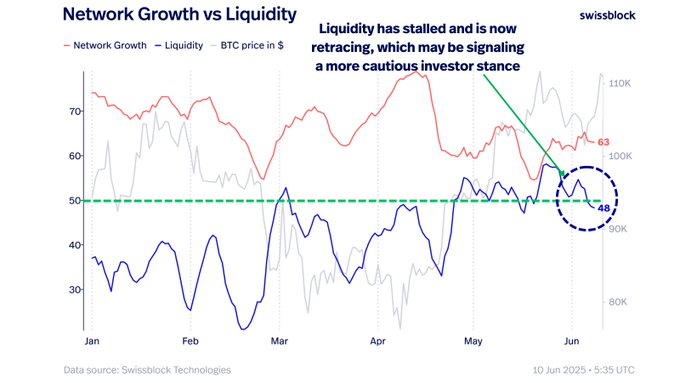

Source: Swissblock/XAccording to Bitcoin Vector, a joint report by Swissblock and on-chain analyst Willy Woo, BTC liquidity has been trending lower for the past couple of days, an indication of falling volume levels, a declining number of transactions and reduced activity.

But Bitcoin Vector says a further correction is unlikely.

“Here’s the interesting part: network growth remains stable, participants are not leaving the market.

This aligns with a key point from Bitcoin Vector: profit-taking remains low, meaning selling pressure is limited.”

Source: Bitcoin Vector/X

Source: Bitcoin Vector/X