Bitcoin Standard Treasury Company (BSTR) will go public with more than 30,000 Bitcoin after a business combination with Cantor Equity Partners I (CEPO), a special-purpose acquisition company (SPAC) with connections to global financial giant Cantor Fitzgerald.

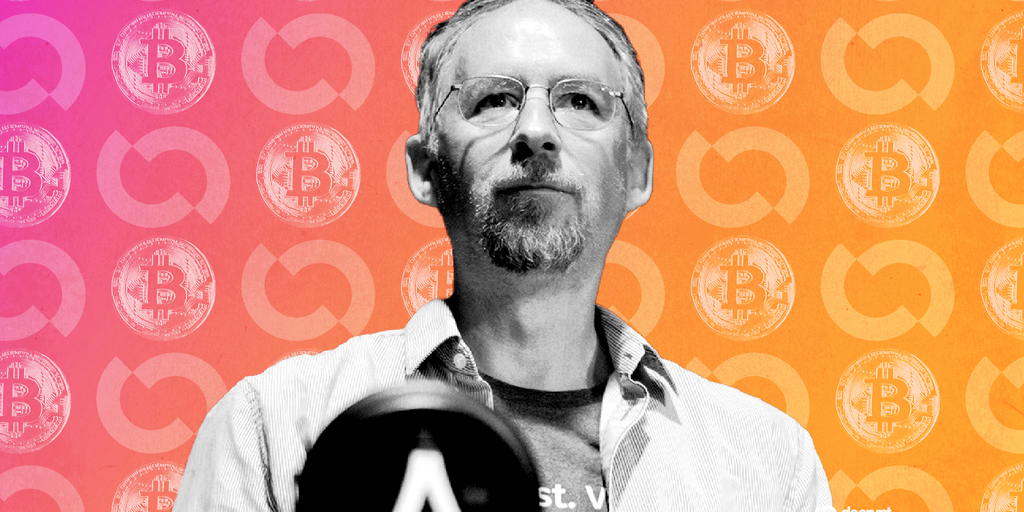

BSTR will open with more than $1.5 billion in PIPE financing on top of a balance sheet of 30,021 Bitcoin, or more than $3.5 billion worth of BTC. The bulk of the BTC will be gathered from its founding shareholders, which includes notable Bitcoin whale and Blockstream Capital CEO Adam Back, who will serve as the firm’s CEO. The Financial Times first reported the impending deal on Tuesday.

“Bitcoin was created as sound money, and BSTR is being created to bring that same integrity to modern capital markets,” said Back, in a statement.

“By securing both fiat and Bitcoin funding on day one—including the first convertible preferred round announced in conjunction with a Bitcoin treasury SPAC merger—we are putting unprecedented firepower behind a single mission: maximizing Bitcoin ownership per share while accelerating real-world Bitcoin adoption,” he added.

The firm’s financing will use a variety of offerings to raise up to $1.5 billion, including the sale of $400 million of common equity, up to $750 million in convertible notes, and up to $350 million in convertible preferred stock. It will use the net proceeds to buy BTC and “build a suite of Bitcoin-native capital-markets products and advisory services.”

“As a long-time Bitcoin advocate, Cantor is incredibly proud to partner with Dr. Back, one of Bitcoin‘s leading luminaries, to launch BSTR," said Brandon Lutnick, Chairman and CEO of Cantor Equity Partners I and son of U.S. Commerce Secretary Howard Lutnick.

Brandon Lutnick is also the Chairman and CEO of Cantor Equity Partners, the entity undergoing a SPAC merger to take Bitcoin treasury company Twenty One (XXI) public with a planned balance sheet of more than 42,000 Bitcoin.

The board of directors for both BSTR and CEPO have approved their respective business combination. The deal is expected to be finalized in Q4.

When completed, the firm will have one of the largest publicly traded Bitcoin treasury firms in existence, trailing only Marathon Digital Holdings (MARA) and Michael Saylor’s Strategy.

Shares of Cantor Equity Partners I (CEPO) are down nearly 9 today and trading at $13.89. Bitcoin is up 0.2 in the last 24 hours at $118,704–about 3.6 off its recently created all-time high of $122,838.

Your Email