The vocal advocate for financial education has shared his thoughts on the state of the markets.

This comes at a time of relentless accumulation and adoption, offering a different perspective on current affairs.

Bubbles Are About To Start Bursting

Those are the words with which Kiyosaki started his post on the social media platform X early this morning.

The entrepreneur further added, “When bubbles bust, odds are gold, silver, and Bitcoin will bust too.”, which he thinks is good news, as if the prices of these assets drop, he will be buying.

This comment follows last week’s post by the investor, who celebrated the leading cryptocurrency reaching over $120,000.

The sentiment was more positive, as it was “Great news for those who already have some Bitcoin.”, whilst further stating that it was unfortunate for people who had not yet purchased any.

The author still recommends caution with accumulation levels, “to not get slaughtered like a hog,” as he anticipates the economy’s reaction before buying more.

“If you have not begun acquiring BITCOIN….I suggest starting very small… starting with a Satoshi.”

His stance on the largest cryptocurrency has changed constantly throughout the month, as he noted at the start of July, “CLICK BAIT Losers keep warning of a Bitcoin crash.”

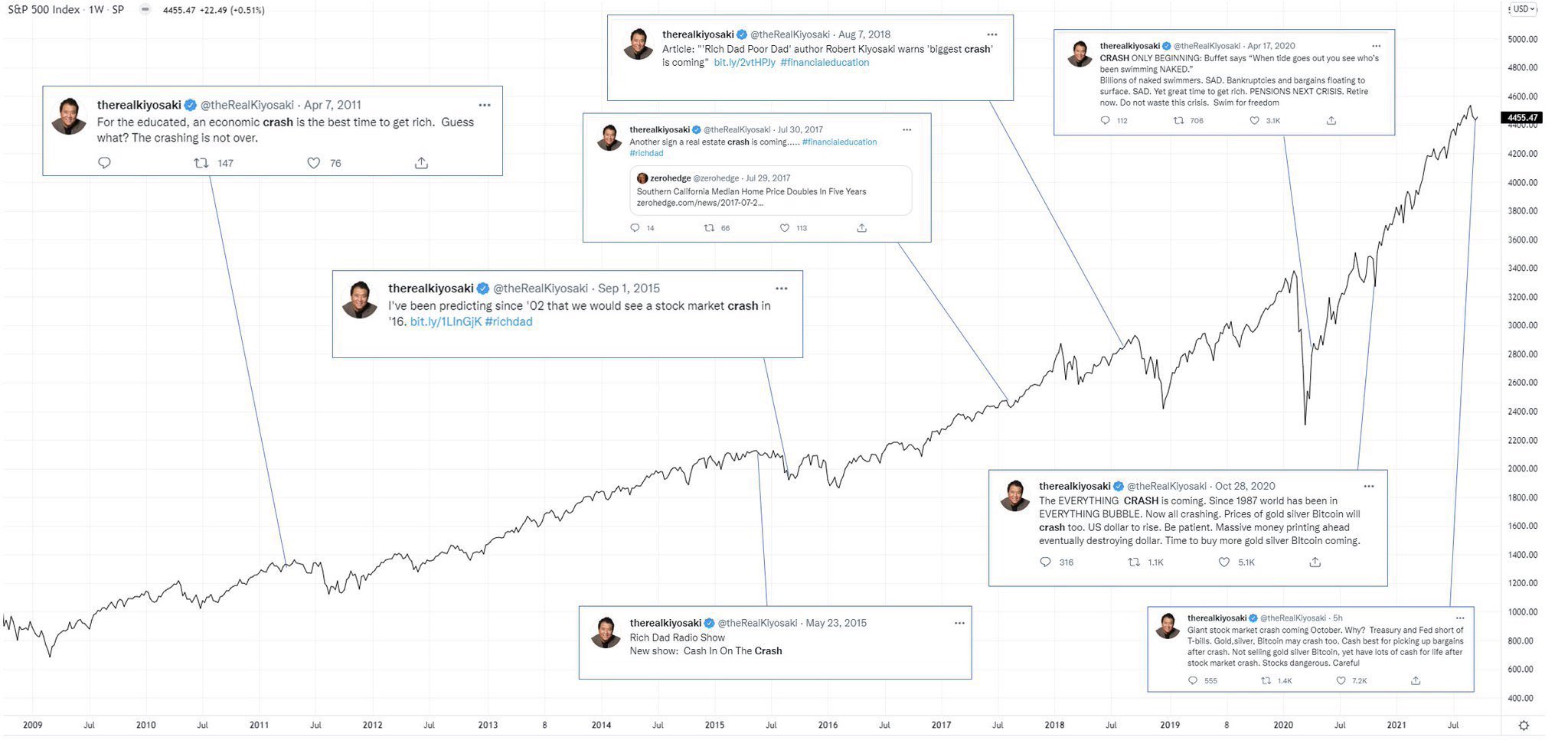

Furthermore, a market newsletter, Brew Markets, shared a sheet with prior predictions of market crashes dating back to 2011, suggesting that the author of the “Rich Dad Poor Dad” series had been incorrect on multiple occasions.

Source: Brew Markets

Source: Brew MarketsBitcoin Is Still Doing Well

Regardless ofKiyosaki’s impressions of the top cryptocurrency, its performance remains stable.

According to data from CoinMarketCap at the time of this writing, the BTC dominance is 60, representing the relative market share of Bitcoin in the overall cryptocurrency space. Although, it’s worth noting that there has been a notable decline in this metric throughout the past week. Altcoins have been outperforming in what many describe as an altcoin season, but it it’s interesting to see if this form of capital rotation will persist.

The site also tracks 30 of the leading market cycle indicators that traders often use to try to predict the top of the crypto market cycle, and none of them have triggered so far.

With institutions, retailers, governments, and the public pouring millions into the asset, it continues to set records across the board.