A former Goldman Sachs executive says that two key factors are driving selling pressure in the Bitcoin market, keeping BTC stuck in a sideways trend.

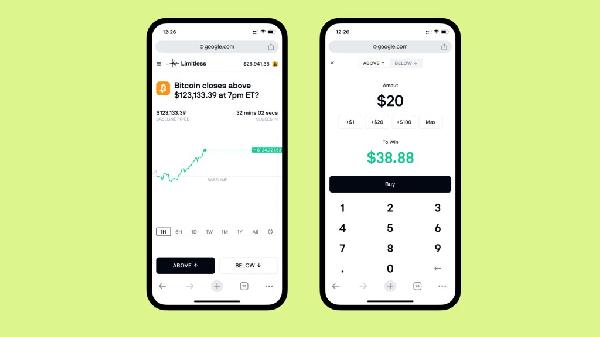

In a new CNBC interview, Bucella, now managing partner at digital assets-focused investment firm Neoclassic Capital, says that despite the “huge demand” for the crypto king from companies seeking to add Bitcoin to their balance sheets and from the spot exchange-traded funds (ETFs), the flagship digital asset is not “mooning” because there are investors who are offloading BTC and diversifying into crypto-related equities.

-->“I think one, there’s been a bit of risk replacement. You have some of these major public companies becoming proxies for where crypto can go. And so there are people replacing Bitcoin spot risk with Circle or Coinbase or [BTC] treasury companies.”

According to the Neoclassic Capital managing partner, Bitcoin miners are also contributing to Bitcoin’s sideways market.

“The other part that’s a bit more technical, and I think maybe less discussed, is a lot of the Bitcoin miners who have been holding Bitcoin are operating in very narrow margin profiles now.

And if you don’t have highly credible, high-top assets with great operating teams to pivot to, at least attempt to get an AI (artificial intelligence) contract or a hyperscaler contract, you have to sort of run these sometimes loss-operating models. And those are seeming to be financed by some Bitcoin sales or other capital markets activities.”

Bitcoin is trading at $107,744 at time of writing, up by around 4 over the past month.