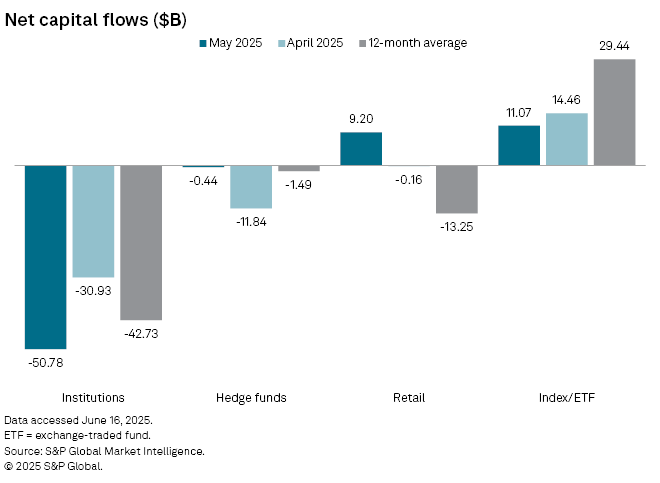

Institutional investors dumped a net $50.78 billion worth of stocks in May, according to market intelligence from S&P Global.

That number surpassed the net $30.93 billion worth of stocks that were unloaded by institutions in April and is above the net monthly average in the past year of $42.73 billion.

-->S&P Global notes that institutions dumped equities in May due to trade concerns and Moody’s decision to downgrade the United States’ credit rating from AAA to AA1.

Explains Thomas McNamara, an S&P Global director of market intelligence,

“Institutions still don’t feel that we are out of the woods in relation to tariffs, recession and overall global uncertainty.”

Source: S&P Global/X

Source: S&P Global/XConversely, index and exchange-traded fund investors gobbled up a net $11.07 billion in stocks last month and $14.46 billion in April. Both of those numbers are significantly less than the 12-month average of $29.44 billion, however.

McNamara says it is “never zero-sum” in terms of stock sales.

“There are a lot of factors that go into this on a general basis, but this month, a main driver was share buybacks. This may also be a reason why the market rebounded like it did without any long-only conviction.”

The S&P 500 is up 0.25 in the past month, and the Nasdaq Composite is up nearly 1.6, though the Dow Jones Industrial Average is down by nearly 1.4.

Follow us on X, Facebook and Telegram