As traditional finance and crypto converge, a growing number of products are emerging that straddle the shrinking divide between the two.

Crypto credit cards are one such product, offering users an array of different perks, benefits, and rewards linked to their crypto exchange account.

But no card is like another. For example, some crypto cards offer flat cashback rewards, while others offer variable percentages based on the spending category.

In this article, we’ll walk through some of the most popular crypto credit cards that are available to users in 2025.

Gemini Credit Card

Image: Gemini

Image: GeminiAmerican crypto exchange Gemini offers a Mastercard credit card to the crypto curious.

Available in all 50 U.S. states, the card provides 4 back on gas, 3 on dining, 2 on groceries, and 1 on all other purchases—paid instantly at the point of sale in up to 50 cryptocurrencies, including Bitcoin. The card’s top reward tiers are capped up to $300 per month, at which point all other excess purchases are paid at 1.

The Gemini Credit Card features no annual or foreign transaction fees and requires a verified Gemini account, which rewards are deposited into.

Avalanche Card

Image: Avalanche

Image: AvalancheAvalanche Card offers a debit card allowing users to spend at any merchant where Visa is accepted using their USDC or AVAX tokens.

Available in most U.S. states, the Avalanche card doesn’t offer direct rewards and carries 0 APR, though fees for foreign transactions, late payments, and returned payments may apply.

The card does not require a credit check and can be used after a user completes a KYC check through the Avalanche Card mobile application.

MetaMask Card

Image: MetaMask

Image: MetaMaskMetaMask Card is a debit card available in early access for U.S. users outside New York and Vermont and select countries globally.

Usable wherever Mastercard is accepted, the card is currently on a waitlist and provides cash back rewards, exclusive event access, and “surprise” perks.

Users must complete KYC and connect their MetaMask wallet in order to make use of the card.

Fold Credit Card

Image: Fold

Image: FoldFold Credit Card is an upcoming Bitcoin rewards credit card with an open email waitlist. Unlike other Bitcoin credit cards, Fold offers users a flat Bitcoin rewards rate for all purchases—2 back for Fold+ subscribers and 1.5 for free users.

Fold also offers up to $250 in sign up bonuses for its credit card, and manages a Fold debit card which provides Bitcoin cashback rewards for its Fold+ subscribers.

Crypto.com Credit Card

Image: Crypto.com

Image: Crypto.comCrypto.com offers a signature Visa credit card available across multiple tiers, with Crypto.com offers a signature Visa credit card available across multiple tiers, with different rewards and welcome bonuses at each tier.

The card is active and provides up to 8 back in CRO tokens, depending on your CRO stake level. It charges no annual fee, though foreign transaction fees vary by tier. Users can unlock perks like free Spotify, Netflix, and lounge access at higher staking tiers. The card blends cashback with premium lifestyle benefits, appealing to those invested in the Crypto.com ecosystem.

Nexo Card

Image: Nexo

Image: NexoThe Nexo Card is a crypto card with dual debit and credit capabilities, primarily available to users in the EU and UK.

In debit mode, users can spend anywhere MasterCard is accepted, opting to spend stablecoins or any other supported asset of their choice. The card in credit mode can offer up to 2 cashback, paid in NEXO tokens, or 0.5 in Bitcoin for top members of its loyalty program which is based on NEXO token holdings. At the lowest tier users can earn 0.5 back in NEXO tokens or 0.1 back in BTC.

While there are no annual or foreign transaction fees, card holders must use Nexo’s crypto platform to hold assets for collateral.

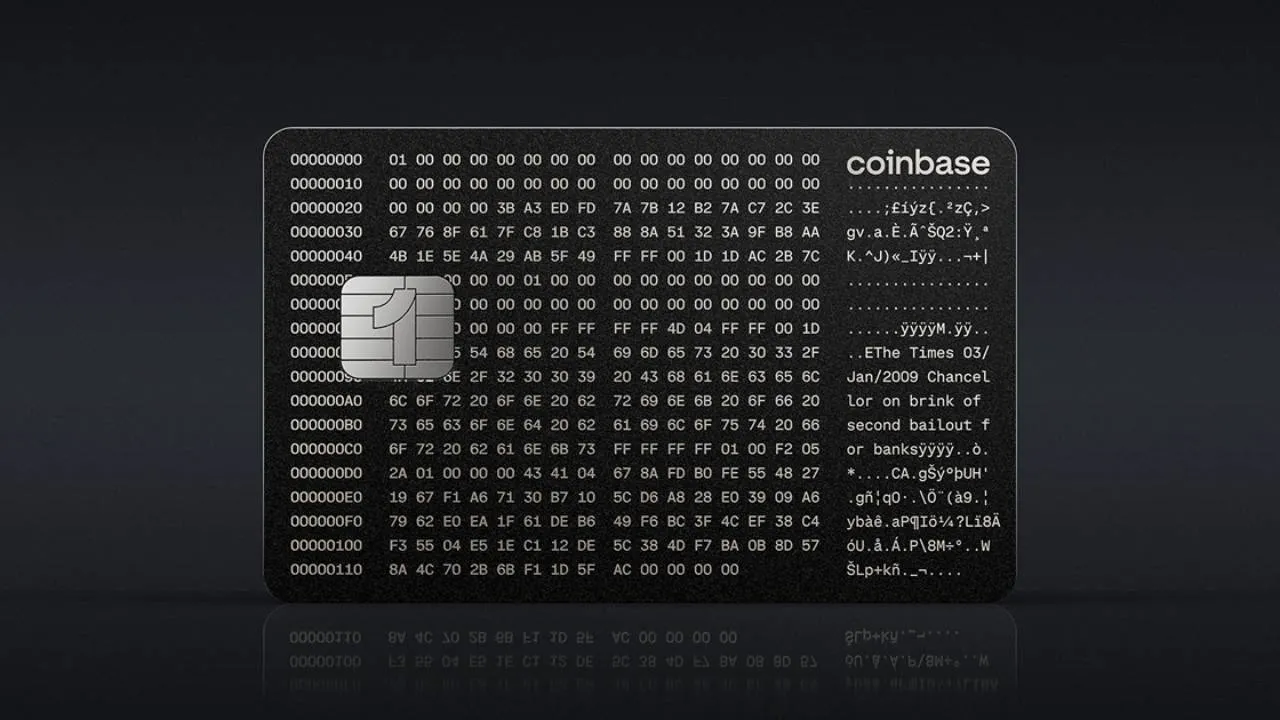

Coinbase One Card

Image: Coinbase

Image: CoinbaseCoinbase unveiled its first branded credit card in June, with expectations of a fall launch.

Launched in partnership with American Express, the Coinbase One Card will offer users Bitcoin rewards on their purchases, with up to 4 back and the potential for different crypto token rewards in the future as well.

The card will be available exclusively for United States-based Coinbase One subscribers.

Additionally, Coinbase has a debit card product product for U.S. users. Like other crypto debit cards, Coinbase will seamlessly swap crypto-to-fiat at the point of sale anywhere Visa is accepted.

Robinhood Gold Card

Image: Robinhood

Image: RobinhoodRobinhood’s Gold card, exclusive to members of its Robinhood Gold subscription service, offers 3 cash back on every single purchase and will allow users to choose crypto, instead of cash as the reward of their choice later in 2025.

The Visa signature card comes with no annual fee or foreign transaction fees and other perks and benefits for travelers. Robinhood Gold subscribers can reserve their via email waitlist.

Your Email