New data from senior Bloomberg analyst Eric Balchunas reveals that US crypto ETFs (exchange-traded funds) beat out Vanguard’s renowned S&P 500 ETF (VOO) in July.

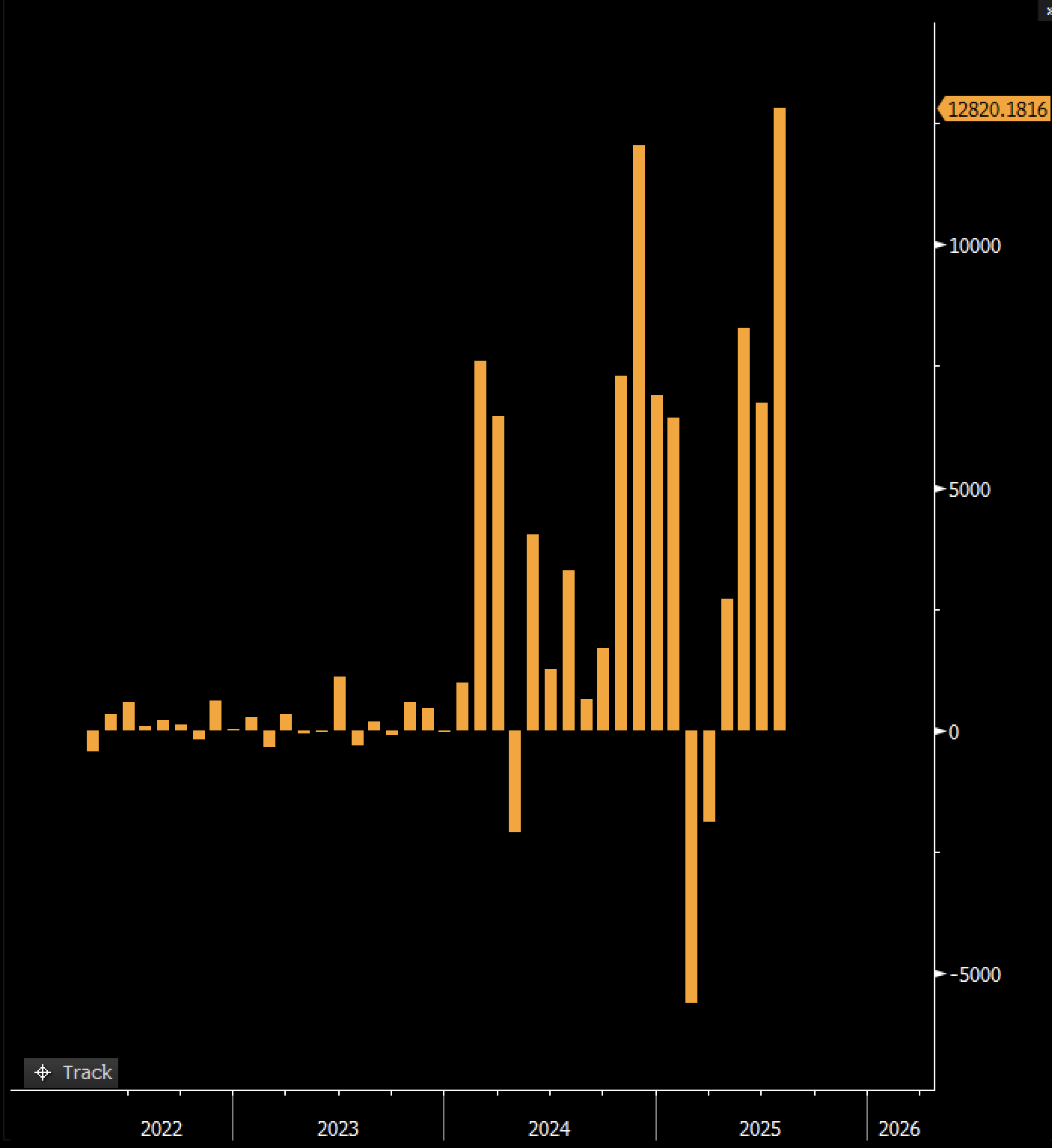

In a new thread on the social media platform X, Balchunas notes that US crypto ETFs had a staggering $12.8 billion worth of inflows in July, outpacing all other ETFs, including VOO, which currently has $713.13 billion in assets under its management.

-->“US Crypto ETFs took in $12.8 billion in July, the best month ever, [at] a $600m/day pace, about double [the] average. As a group, that’s more than any single ETF did, including the Mighty VOO.

Further, every ETF in [the] category took in cash (ex the converted trusts) w/ Bitcoin and Ether making equal contributions. Most all-around dominant performance since the Eagles ended the Chiefs in the Super Bowl. Will be hard to top.”

Source: Eric Balchunas/X

Source: Eric Balchunas/XThe analyst goes on to say that asset management titan BlackRock’s iShares Bitcoin Trust ETF (IBIT) is doing well and drawing in new customers.

“Amazing stat: 75 of the investors who bought IBIT ($87 billion via one million people) were first-time customers of BlackRock. And 27 of them went on to buy another iShares ETF. Just a total coup for BLK all around.”

According to Balchunas, IBIT – which launched in January 2024 – had a significant hand in Bitcoin’s (BTC) massive price growth over the last two years.

“1) ETFs hold BTC at a 1:1 ratio. There is no lending, there is no paper IOUs. ETFs are clean and above board and every dime of AUM is connected to the proportional Bitcoin.

2) Zoom out: Bitcoin is up nearly 300(!) since the infamous BlackRock filing two years ago. ETF flows big part of that.

3) From what I am hearing on here, the selling is annoyed OGs who don’t like that Wall St. and the government has adopted BTC. I guess they prefer BTC to have intermediaries like Sam Bankman-Fraud instead.”

Bitcoin is trading for $113,763 at time of writing, a 3.2 decrease on the day while IBIT and VOO are valued at $64.27 and $572, respectively.

Follow us on X, Facebook and Telegram