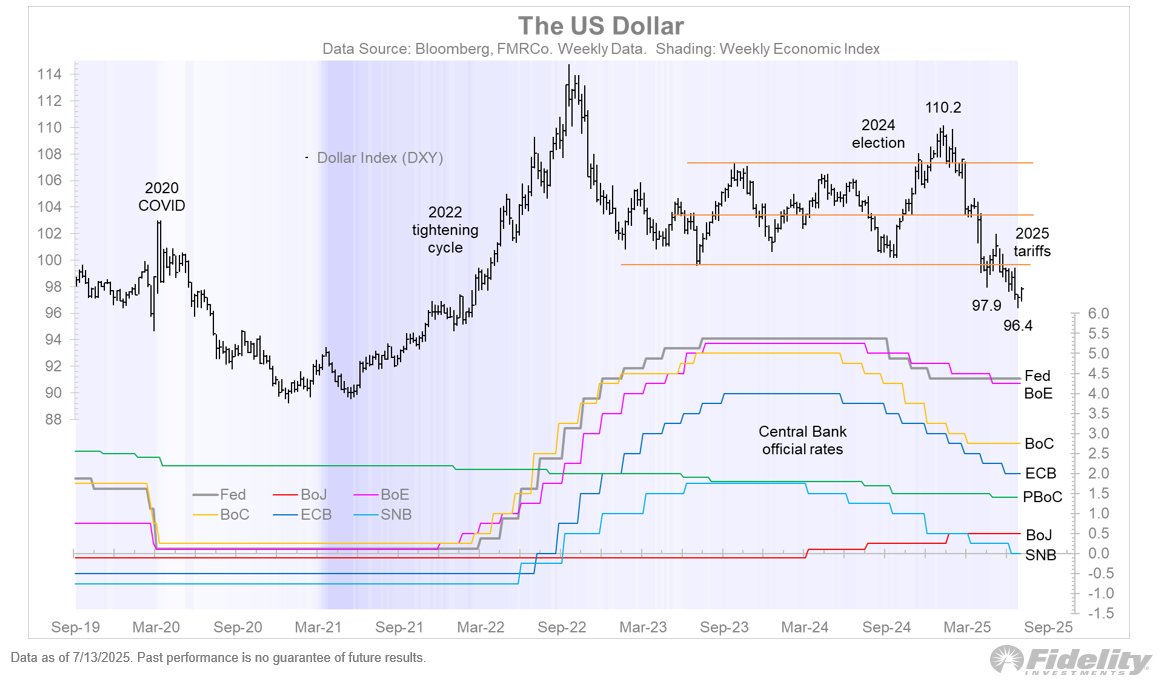

Fidelity Investments’ global macro director Jurrien Timmer says that the US dollar’s global supremacy may erode further if one event occurs.

In a new thread on the social media platform X, Timmer says that if the Fed is forced to prop up the bond market, such as by buying the debt securities, the US dollar index (DXY) may tumble even lower.

-->“If the Fed is forced back into the bond market to hold down nominal and real rates, the dollar may well lose more of its supremacy premium. Currencies are the release valve for unsustainable fiscal policy, as Japan found out a few years ago. The same is now true for the dollar, which continues to lose strength despite the Fed’s hawkish policy stance.”

Source: Jurrien Timmer/X

Source: Jurrien Timmer/XThe DXY, a measure of the value of the dollar relative to a basket of six other leading currencies from major economies, is currently at 98, down over 9 on the year.

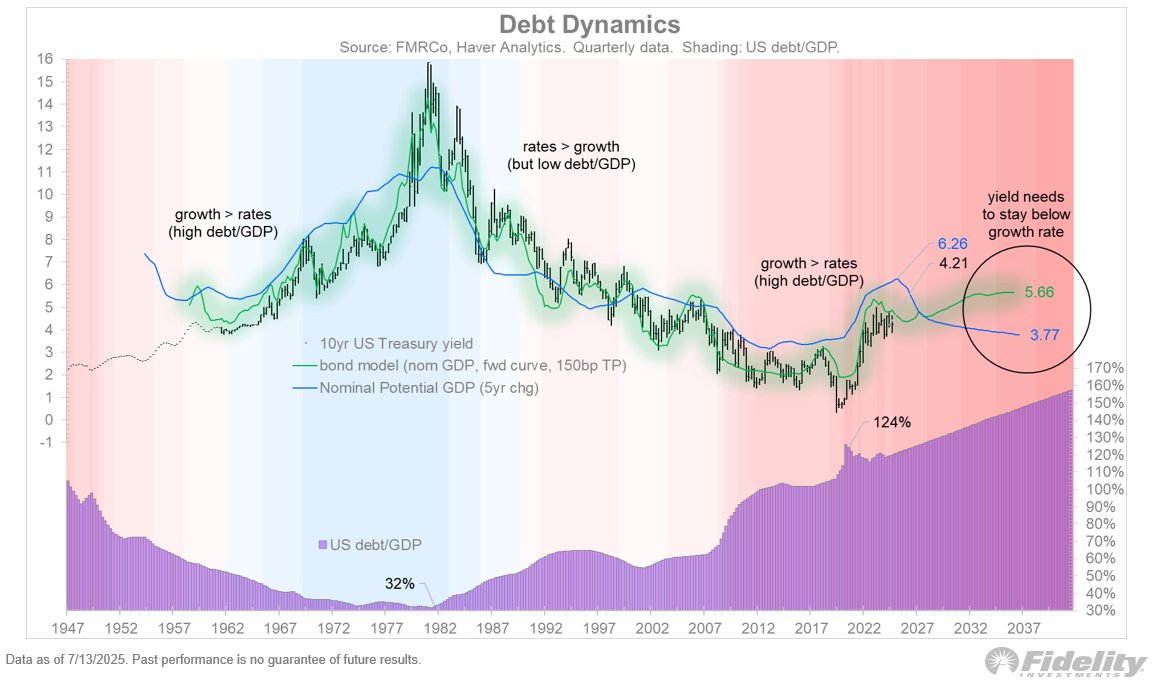

Timmer also says that if GDP growth cannot outpace the interest rate paid on government debt, the Fed intervention in the bond market will likely have to occur.

“With the debt ceiling now passed, the debt is rising again and the jaws between what the Treasury is selling and what the Fed is buying continue to widen. This will only last for so long, in my view. We are now in round two of fiscal dominance, with the first $5 trillion helicopter drop taking place during COVID and now the second one about to get underway from the OBBB (One Big Beautiful Bill Act).

The math is simple but difficult: as long as nominal GDP growth outpaces the funding rate (10-year Treasury yield), the debt can be considered sustainable. Hopefully, that happens, as a capex cycle (capital expenditure) from both the OBBB and the AI (artificial intelligence) boom increases productivity and therefore the non-inflationary speed limit for the US economy.

If not, and if the term premium rises further, in a few years we could have an unsustainable debt spiral on our hands, requiring the Fed to re-enter the bond market to suppress the term premium once again.”

Source: Jurrien Timmer/X

Source: Jurrien Timmer/X